A potential slowdown in economic activity is on the way. You might be one of the people feeling anxious about its effects on the housing market. Fortunately, you can breathe a sigh of relief. Experts are saying the recession won’t last long. Also, a housing crisis isn’t always the end game. Does it completely stop you from buying or selling a home? Realtors see otherwise. Transactions continue despite recession threats. With these in mind, you can put the fear at the back of your head.

Extremely Low Housing Supply Keeps the Market Running

The lack of housing supply hit a record low earlier this year. There is an estimated shortfall of about 4 million homes due to the housing crash of 2008. As a result, a lot of homebuilding companies went out of business.

First-time home buyers, largely Millenials and Gen Z, show interest in purchasing despite the recession. Due to the imbalance of housing supply and demand, competition rises as soon as a listing goes out. In effect, this keeps housing activity churning despite higher interest rates.

According to the National Association of Realtors, the median sales price in June reached a record high of $416,000. That’s up 13.4% from last year, despite a drop of 14.2% during the same period. With the increasing demand for listed homes, prices keep rising instead of going into a deflationary spiral. Thus, a slowed economy doesn’t mean home prices will fall too.

In addition, the 2008 housing market crisis and today’s mortgage underwriting are different. During the subprime meltdown, taking out mortgages you couldn’t afford was encouraged. What’s worse is that you don’t need documentation to prove you can afford it. But things are different now. New regulations over the past decade now require you to show you can pay your mortgage. So no, a market crash now isn’t in the books.

An Economic Decline Decreases Mortgage Rates

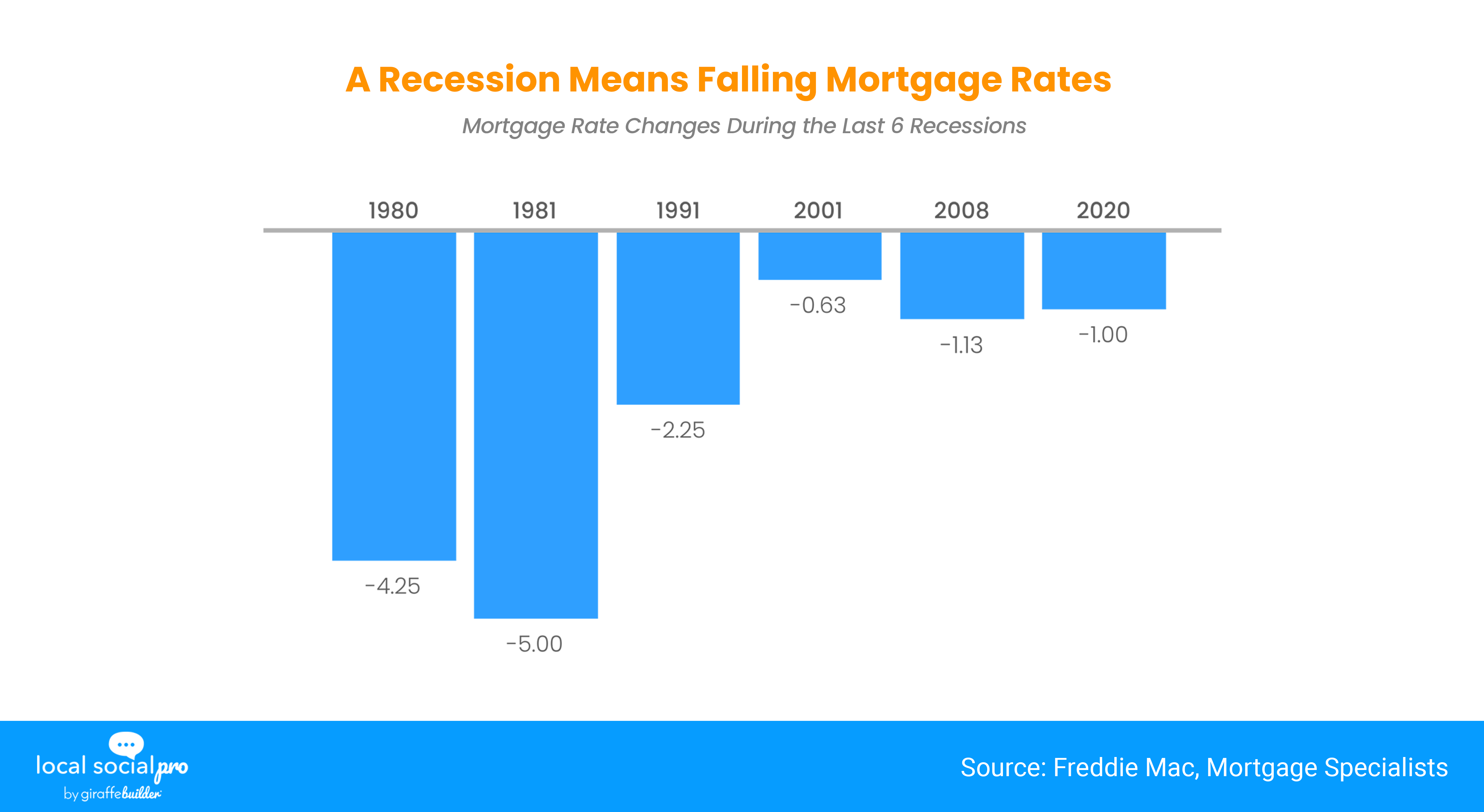

With higher housing prices, the recession brings falling mortgage rates. History proves this. You can see a positive relationship between the two. According to Bankrate, the Fed usually lowers interest rates to stimulate the economy and gives you incentives to spend your money. Due to this, mortgage rates have become more affordable, opening opportunities for people like you looking for a home.

This year, the rates are turbulent due to the response to inflation. The fixed mortgage rate for over 30 years is roughly 6-7%, which impacts affordability.

Is Now a Good Time to Buy or Sell a Home?

A piece of advice is to base your decision on your situation. Realtors see more normalcy and balance in the market. However, tech layoffs and stock and cryptocurrency losses can cause changes in judgment. If you are working in an industry with job reductions or are in danger of them, you might have to rethink making big purchases.

The Bottom Line

There is still a lot of debate about whether the U.S. is facing a recession or not. However, there is nothing to worry about regarding the economic slowdown, as there is a silver lining in the current housing market. A recession doesn’t mean falling home prices but decreasing mortgage rates. However, don’t be too confident, as the economy is ever-changing. So, whether or not you plan on buying or selling a home depends on your current situation. But the good news is that a recession doesn’t equal a housing crisis.

What To Do:

Did you find this read interesting? Need expert and white-glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!