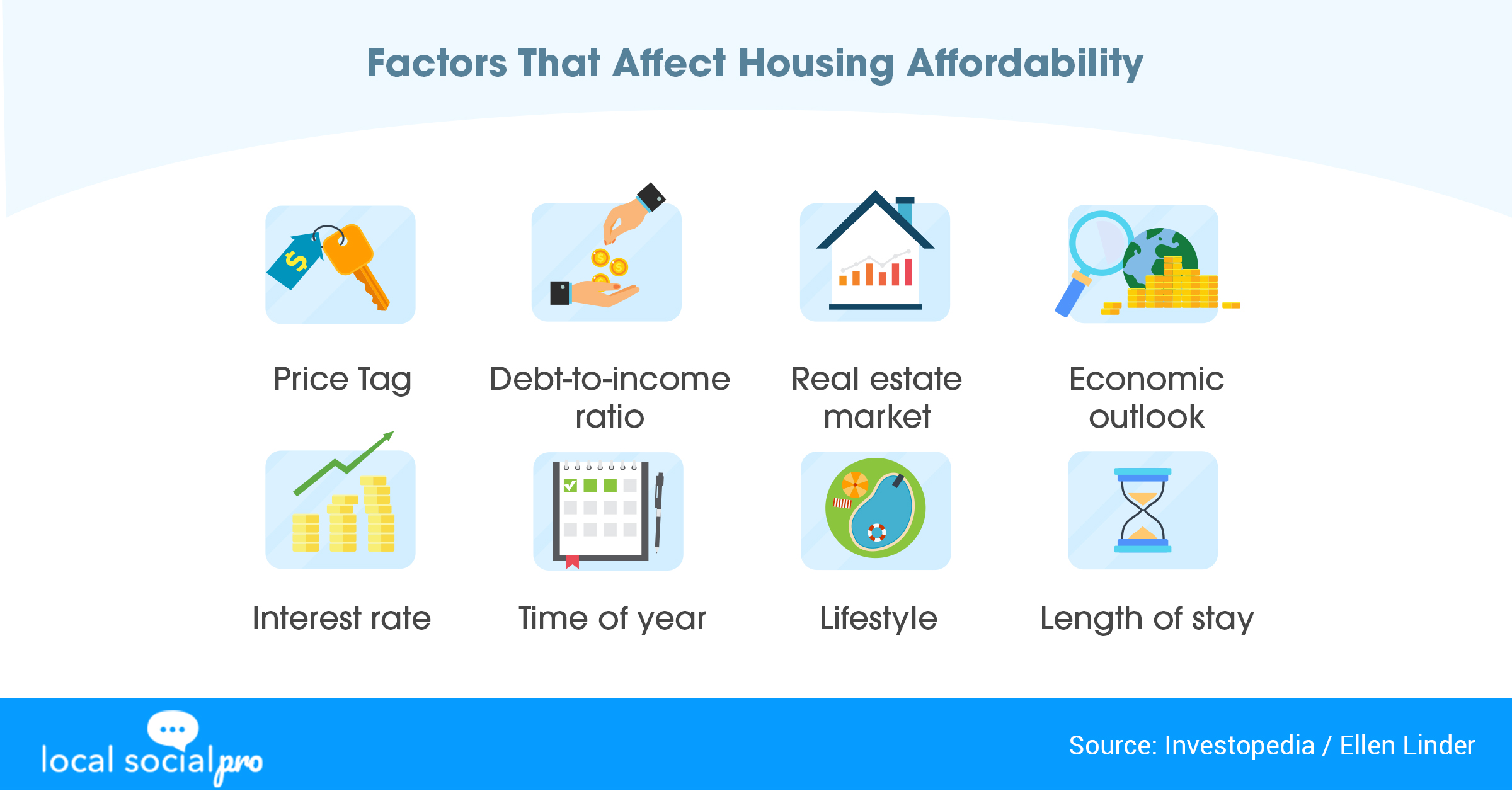

The first question you’re probably going to ask yourself if you’re considering purchasing a home is “how much can I afford”. Determining the answer requires looking at a number of different factors. It’s essential to learn how to evaluate what “affordability” means before buying that house that seems like a great deal. You must take into account a number of variables, such as the debt-to-income (DTI) ratio and mortgage rates. For this reason, you should be familiar with all aspects of home buying. You’ll gain the ability to decide in a way that benefits both your family and your wallet.

Know Why You Want to Purchase a Home

Set your financial and personal objectives. Buyers should consider their moving plans as well as the features, amenities, and location they want in a home as well as how long it might take them to save for a down payment. Knowing your debt-to-income ratio is the first step. The Federal Housing Administration (FHA) typically uses the 43% debt-to-income ratio standard as a benchmark for approving mortgages. This ratio determines whether the borrower can afford the monthly payments. Depending on the state of the housing market and overall economic conditions, some lenders might be more lax or strict. You should also take the front-end debt-to-income ratio into account, which compares your monthly income to the debt you would accrue from housing costs alone, such as mortgage payments as well as mortgage insurance. Lenders prefer that ratio to be no higher than 28% in most cases. Give yourself some financial wiggle room by deducting the cost of a particularly expensive hobby or pursuits from the calculated payment before you practice making mortgage payments. You might have to make sacrifices or start considering a less expensive property as your dream home if the remaining funds are insufficient to purchase the dream home.

Consider The Housing Market

The housing market economy in your current city or the one you intend to move to is the next thing you should think about, assuming you have your financial situation under control. An expensive investment is a home. Although it’s great to have the money to make the purchase, having the money doesn’t tell you whether or not the purchase makes financial sense. Although historically real estate has been regarded as a secure long-term investment, recessions and other catastrophes can put that theory to the test and cause prospective homeowners to second-guess their decision. Make sure to include the cost of mortgage interest payments, improvements to the property, and recurring or regular maintenance in your calculations if you plan to purchase the property with the expectation that its value will increase over time.

Making decisions can also be influenced by the seasons of the year. If you want to browse the largest selection of homes, spring is likely the ideal season to do so. Winter may be a better time to look for a home (especially in cold climates), while the height of summer in tropical states may be preferable if you want sellers who might encounter less traffic and may be more flexible on price. The selection may be constrained due to smaller inventories, but sellers are unlikely to receive multiple offers at this time of year. In any case, more important than the season is your own financial preparedness. This entails having your finances in order and your credit in good standing so that you can easily obtain a fair mortgage.

The Bottom Line

If you approach the decision to become a homeowner with preparation and open eyes, it can boost your long-term financial outlook and give you a sense of pride. There are many moving parts and intricate steps involved in buying a home, but these factors—along with the professional knowledge of your local professional and mortgage lender—can help you navigate the process easily. You’ll feel more confident in your choice and look forward to receiving the sought house keys on closing day if you do your research in advance.

What To Do:

Did you find this read interesting? Need expert and white glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!