One of the most valuable investment strategies and privileges of homeownership is equity. Gaining equity is essential since it progressively converts your loan into an investment. There are a few ways to access this equity, but in general, wealth is built over years as your percentage of “free and clear” ownership of the house rises. While the process of accumulating equity is a lengthy one from a financial standpoint, more immediate market situations can often generate significant profits or losses. There are several strategies to increase the equity in your house:

-

Deposit a fairly large down payment

-

Fixate on paying off your mortgage

-

Make a larger monthly payment

-

Keep your house for five years or more

-

Update and improve curb appeal

A home equity loan helps lower the cost of purchasing a property and increases the buyer’s liquidity. There are a few key benefits to using home equity expressly to purchase an investment property. Thus, if you’re thinking about moving or purchasing a new home, equity can be your ally.

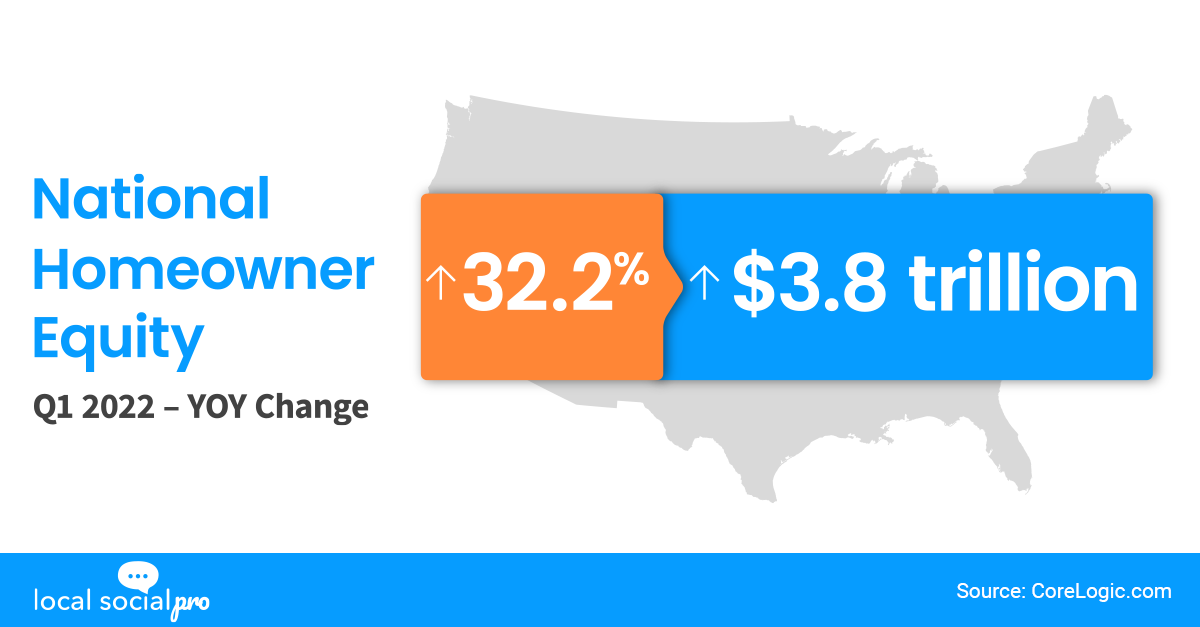

According to CoreLogic analysis, U.S. mortgage-holding homeowners, who own around 62% of all properties, have seen their equity rise by a total of nearly $3.8 trillion since the first quarter, an increase of 32.2% year over year. Home prices are increasing as a result of the persistent imbalance between the number of properties for sale and the number of potential buyers. As a result of the market’s increased demand, your home is now valued significantly. In essence, your equity has increased because your home’s value has presumably improved greatly. As per CoreLogic’s most recent Homeowner Equity Insights report, the average homeowner’s equity increased by $64,000 during the past year.

Price growth may not always be advantageous, but it is beneficial for homeowners’ equity. According to CoreLogic’s president and chief executive officer,

“Price growth is the key ingredient for the creation of home equity wealth…This has led to the largest one-year gain in average home equity wealth for owners and is expected to spur a record amount of home improvement…”

The benefits of home equity assets include raising your down payment, cheaper interest rates since they are covered by collateral in the form of real estate, and helping you resolve financial issues. This implies that you can avoid the high-interest rates associated with other forms of funding, such as hard money and personal loans, by using a home equity loan.

The Bottom Line:

When getting ready to move or buy a new home, understanding how equity functions is a crucial first step. The equity you accumulated in your existing home is returned to you when you sell it. It might even be just what you need to fund a big portion of the down payment on your next house. Nevertheless, if you’ve been delaying selling your home, or you’re concerned that the continuous home price increase will prevent you from affording your next property, rest assured that your equity can support your relocation or new home purchase.