Although it may be tempting to postpone purchasing a home until rates fall, no one can foresee when or even if that’s likely to happen. Recently, several “experts” have been saying that the housing market is likely to collapse due to its dire status. Can we fully believe that these are #Facts or just mere talks? If we’re not in a housing bubble, is this the right time to invest in real estate despite all the doom and gloom? The simple answer is yes — and it’s the best decision you can make.

Do not be alarmed by rising mortgage interest rates

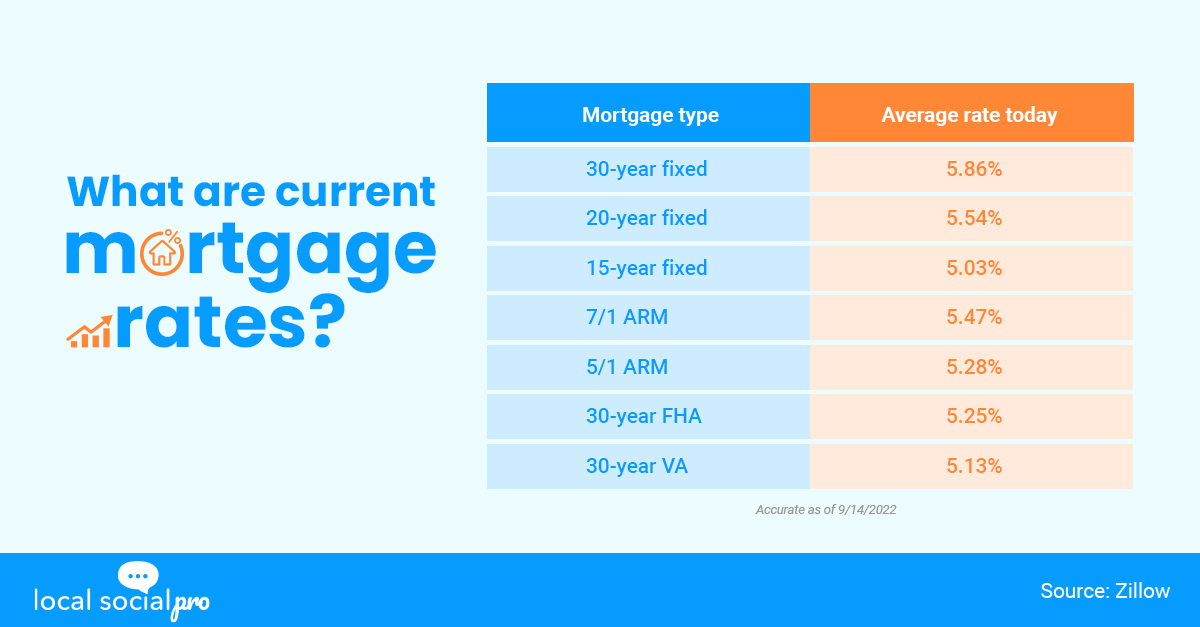

Mortgages have already increased this year, and it’s likely that they will do so significantly. In response to inflation, the Fed anticipates raising the federal funds rate several times in 2022, which might be an indication that mortgage rates will also climb higher. However, there is no reason to be concerned about buying a home while mortgage interest rates are increasing, considering that the current rate is still historically low. There will be recurrent increases in mortgage rates. It’s an unavoidable reality since the market in which we live is ever-changing, so are rates. Interest rates typically increase when the economy is performing well. Mortgage interest rate increases are an indication that consumer confidence is returning, and as incomes rise and the labor market becomes more competitive, these factors will eventually contribute to higher prices.

Contrary to renting, purchasing a home is nevertheless a wise investment amidst rising mortgage rates. Not everyone understands that it’s not about what rate you’re locked into because rates are constantly changing. With a shifting market, you have the flexibility to refinance at a later time. Your focus can be diverted away from the actual value of the loan if you are only focused with your mortgage rate— which could be a costly error. The best loan offer does not equate to lowest interest rate. Get the home first, lease the rate.

The Bottom Line:

While individuals wants lower mortgage rates, higher rates don’t automatically mean you shouldn’t purchase a home now— it’s impossible to time the real estate market. Real estate investing has proven itself to be secure and safe because of the home’s tangible commodity. Your investment is unlikely to lose value, and if it does, it usually only does so momentarily. Real estate doesn’t depreciate over time due to inflation — it gets better. Since homes increase in value over time and help protect your assets for the future, buying one is more important than ever.

What To Do:

Did you find this read interesting? Need expert and white glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!