Throughout the years, changes in the market remained due to the different factors that affect it. Supply and demand have significant influences. Thus, while there are current negative views on the economy, a positive light is still present. As long as there are home buyers, housing availability remains. Plus, no data show a lack of interested people willing to purchase a house. In addition, millennials make up almost half of the population. They also comprise most first-time home buyers. Thus, the demand for housing remains solid, if not higher, with the current low housing inventory.

Real Estate Supply and Demand

The housing market relies heavily on supply and demand. So, it is why it is used as an indicator in the industry.

The market’s current state can dictate the equilibrium price of a property. Prices can spike when there is a low housing supply, resulting in bidding wars. When it happens, the seller chooses the best offer. In addition, high demand and a low supply of quality houses increase home prices. On the other hand, an oversupply of homes during a falling economy will result in dipping prices.

What Affects Housing Supply and Demand

Identifying the precise values of homes connected to supply and demand is hard. Building new homes and fixing houses to be brought back to the market takes a while. Thus, real estate is unlike other industries. Buying and selling homes and other properties take time! Due to this, transactions can be illiquid in form as they take longer to consummate.

Lower interest and borrowing rates can affect the housing demand. Buyers are more willing to pay for interest as they are less expensive. In addition, financing the home is easier as the price is not as burdensome. Thus, with more buyers in the market, home demand grows. Moreover, more gets interested in purchasing when there’s a limited supply of homes at lower prices. On the other hand, when various natural calamities happen, the demand for homes decreases.

“Home prices are high, mortgage rates are high, and inventory is still quite low. If the economy and the job market hang in there, we’ll see some pickup in housing activity. But there are no material changes to the price, rate, and supply fundamentals.” – Greg McBride, Bankrate Chief Financial Analyst

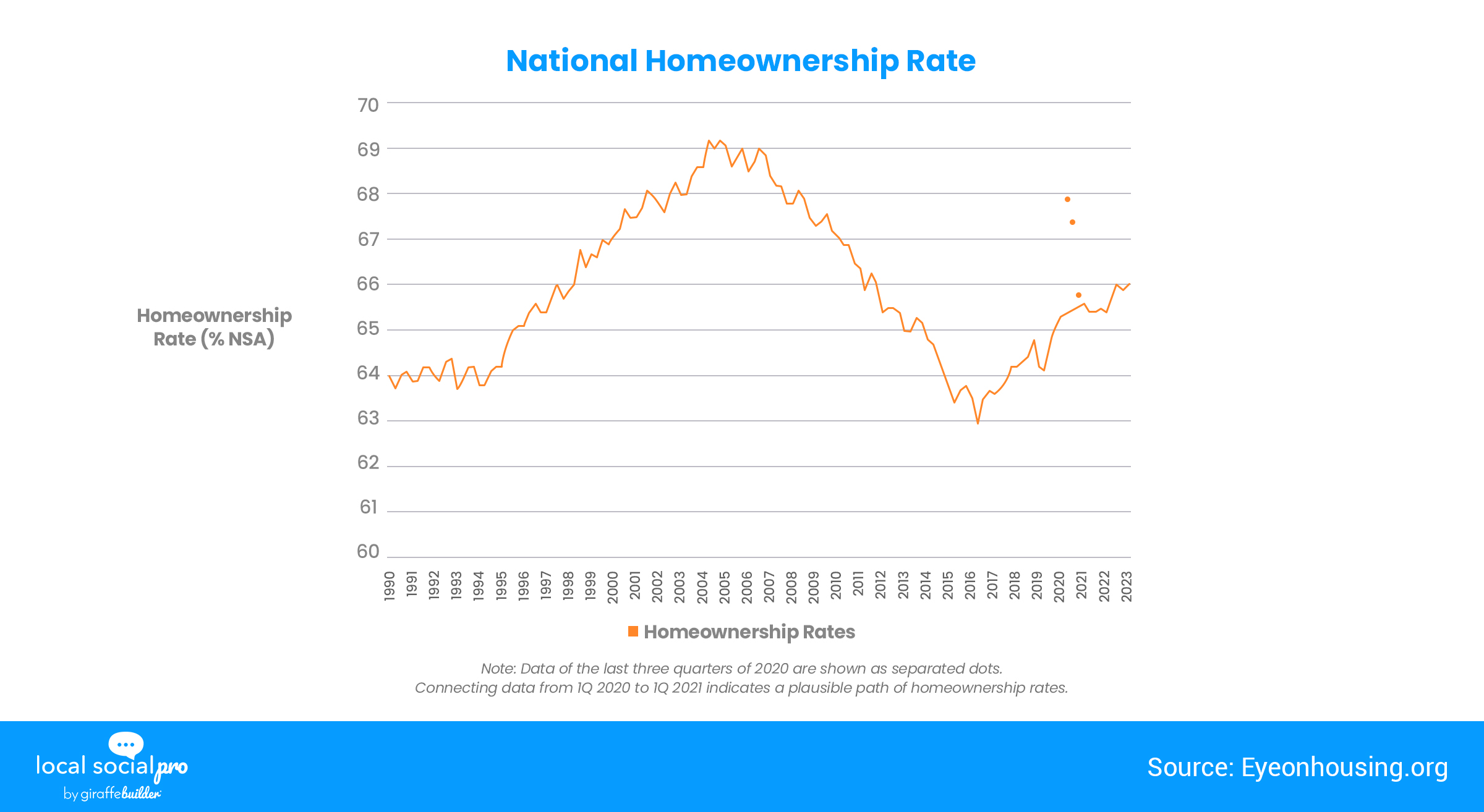

Unchanged National Homeownership Rate

As per the Census Bureau’s Housing Vacancy Survey, the homeownership rate remains at 66% during the first quarter of 2023. This is despite the tight housing supply. There are no observable statistical changes in this rate from the fourth quarter reading (65.9%). Also, there is a 3.2 percentage-point difference from the 69.2% peak in 2004. Additionally, it remains below the 25-year 66.4% average rate.

The Bottom Line

The housing industry and its economic factors are a transactional market that relies on supply and demand. It is because they make use of buildings and properties. Also, several factors have a role in the availability and price of homes. Thus, how buyers and sellers interact depends on the law of supply and demand.

What To Do:

Did you find this read interesting? Need expert and white-glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional specializing in this topic and more!