Understanding the State of the Housing Market

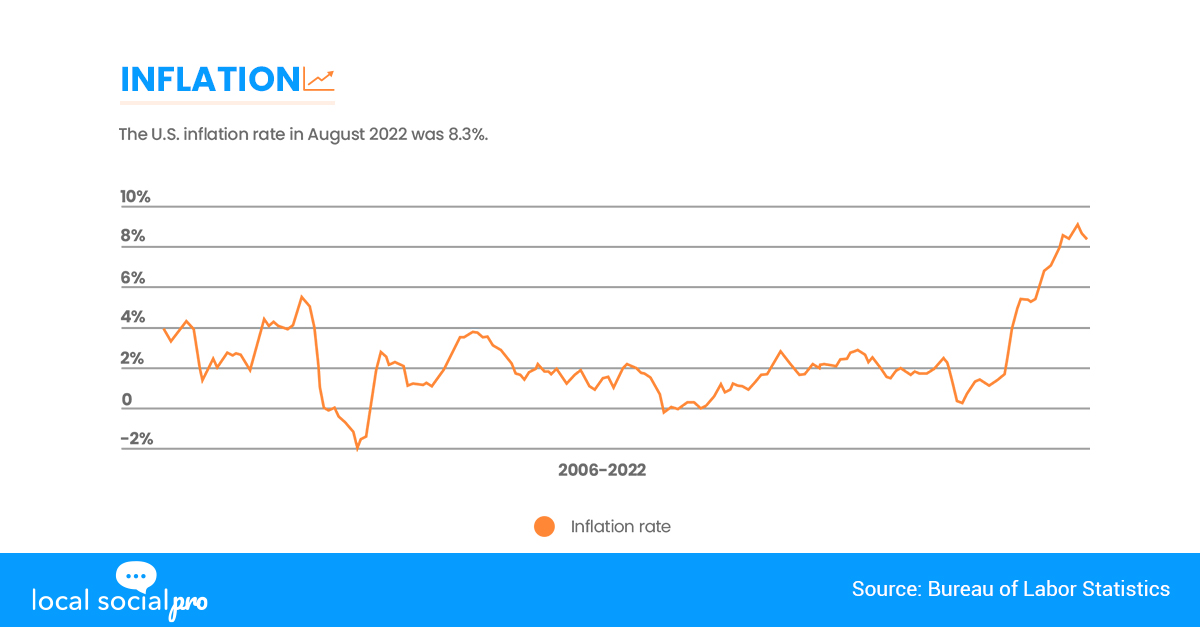

Inflation and mortgage rates are the two main factors that individuals are dealing with in light of the current upheaval in the housing market. Since the Fed started raising interest rates, the housing market has been slowing down. And when rates rise, it is cooling more quickly. According to S&P CoreLogic Case-Shiller National Home Price Index, US home prices fell in July compared to June, the first month-to-month drop since January 2019.

Based on the data given by CoreLogic, home prices nationwide increased 15.3 % over the previous year. Even while there is a slowdown, it is still significant by historical standards, plus inflation is making things worse. The most recent index from Fannie Mae shows that both homebuyers and sellers have a continuing tendency to be less enthusiastic about their economic future. In line with this, how can we truly comprehend inflation and mortgage rates as key determinants of the current housing market along with all the turmoil that is taking place? Let’s take a closer look.

The Economy and Housing Market continue to be Influenced by Inflation

Individuals are worried about their financial future and present as a result of inflation and excruciating price hikes. The real estate market is gradually calming down to a pre-pandemic pace after about two years of upheaval. At the same time, according to NAR, the median sales price nationwide has reached an all-time high of more than $400,000, a 14.8% rise from the previous year. The simple rule of supply and demand can be used to explain those prices: There have been a lot more potential homebuyers than available properties.

However, here’s how experts view inflation:

“Inflation coming back down doesn’t mean prices falling; it just means prices not rising as fast”

– Greg McBride, chief financial analyst at Bankrate

Having said that, your life’s circumstances may compel you to purchase a home right away, and it’s a valid reason just as any. If you want to profit when you sell the home, be ready to stay in it for a while because you’re buying at or around the peak of the market.

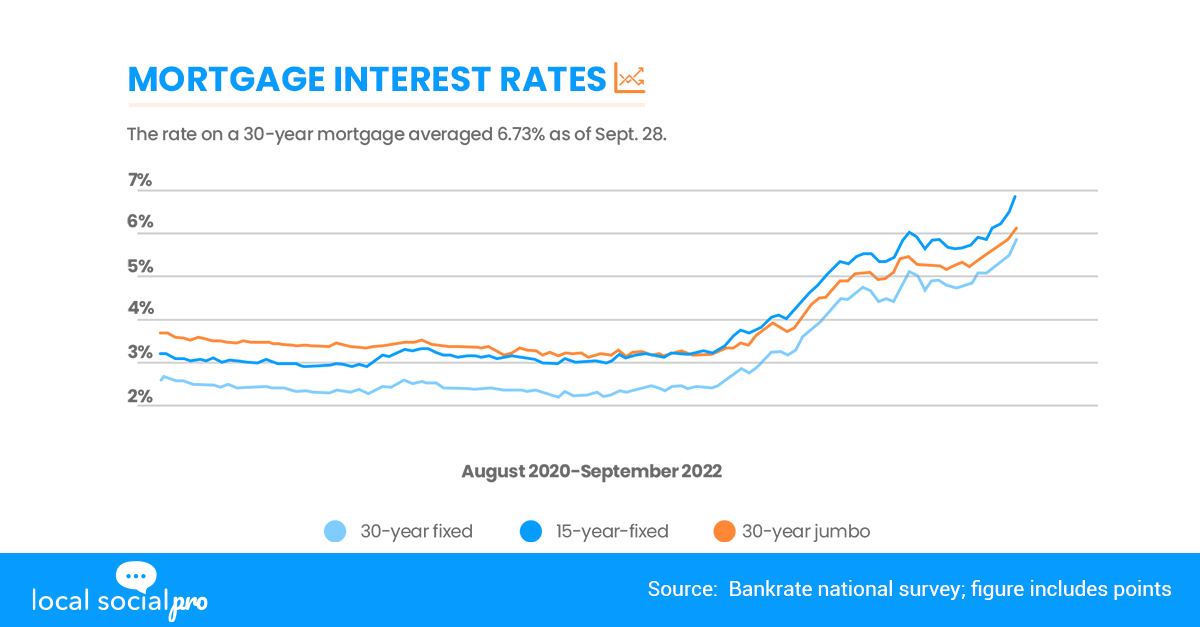

The effect on the Rise of Mortgage Rates

The average rate today is the highest figure for mortgage rates since 2008 and another proof that the Great Recession’s 10-year run of historically low rates was coming to an end. The third straight rate hike by the Federal Reserve of three-quarters of a basis point last week would appear to put increased longer-term strain on mortgage rates. It shows that they have been acting aggressively to limit inflation.

According to economists, By the end of 2022, interest rates were predicted to climb, but not as swiftly as they have when the Fed began to seriously combat inflation. Although the increase in rates is also putting pressure on affordability, it may reduce competition among homebuyers as they soared beyond the 6 percent barrier.

“Only when inflation calms down will we see mortgage rates begin to steady”

– Lawrence Yun, chief economist for the National Association of Realtors.

The Bottom Line

Future housing market trends will be influenced by both mortgage rates and inflation. However, it is likely that mortgage rates will continue to rise throughout 2022, despite the fact that no one can forecast how they will act. It’s crucial for home buyers to keep in mind that even if mortgage interest rates are rising, they still fell to historic lows last year and 2020. The best route to navigate this constantly changing market is to rely on the data provided by experts. They can offer you ideal advices to keep you informed and make sure that you make the best decisions possible.

What To Do:

Did you find this read interesting? Need expert and white glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!