Most people refer to homeownership as the “American dream”. It involves more than just owning a house. Significantly, it is a financial commitment to your future. You may secure both your wealth and yourself by making real estate investments. It has a number of advantages, including monthly rents, equity, passive income, and tax benefits. The real estate market has never declined over time, despite frequent fluctuations. Many believe that even in the midst of the rising inflation, real estate investments still flourish.

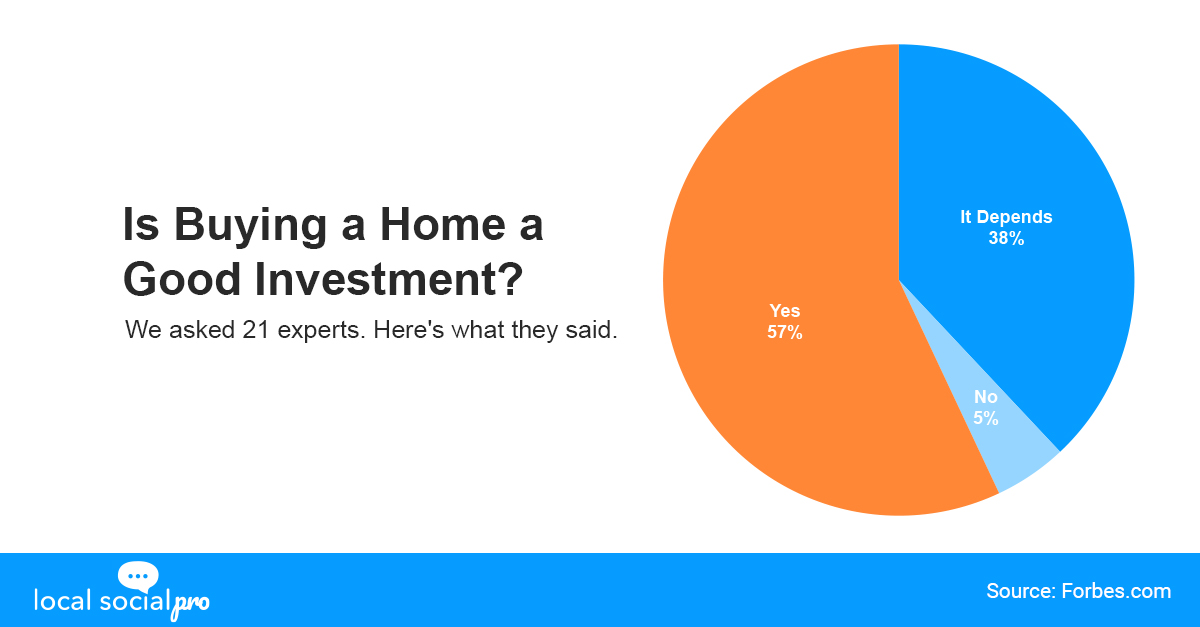

Forbes Advisor posed the question, “Is buying a house a good long-term investment?” to two dozen financial and real estate professionals. The majority (57%) claimed that purchasing a home is a wise investment, 38% claimed that it depends on a number of factors, and only 5% disagree.

Given that most experts consider that buying a home is a wise investment, it is reasonable to state that homeownership has consistently demonstrated to have positive effects on both the economy and wealth. One of the respondents stated that:

“Owning a home is how most Americans build wealth. A portion of every housing payment made by a homeowner is applied toward paying down the home loan balance (principal payment), which increases the equity in the home and helps to build a homeowner’s net worth.”

– Carlos Miramontez, Vice President mortgage lending at Orange County’s Credit Union

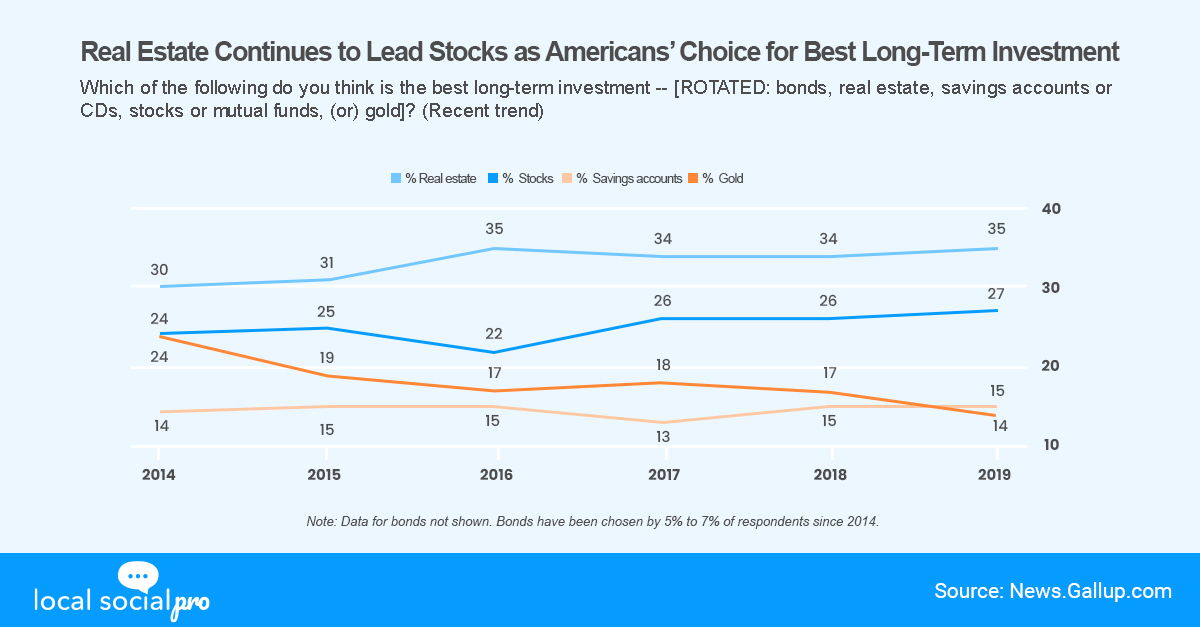

More Americans (35%) still think real estate is a better long-term investment than stocks (27%) or other kinds of securities. For the eighth year in a row, real estate is not only ranked the ideal investment, but more Americans choose it than ever before.

Since 2002, Gallup has asked the question on the best investment, and the responses from Americans have shifted, mostly in response to the activities of different investment options. The biggest number of Americans who chose any investment category in a single year in Gallup’s trend indicated real estate was the best investment in 2002 at 50% of adults when house prices were rising quickly. Housing remained the top choice for Americans five years later, although, with fewer people at 37%. Americans who do not own stocks or property are more likely to view real estate (31%) as a superior investment than stocks (18%), whereas 23% choose savings accounts or certificates of deposit (CDs).

According to the Federal Reserve’s 2020 Survey of Consumer Finances, if you own your home, you probably have a higher value than someone who rents. The fact that homeowners’ net worth is far more than 40 times bigger than that of renters only serves to support the notion that buying a home is a wise financial decision. It will be more crucial than ever to comprehend the financial advantages of homeownership in 40 years. Prices are rising everywhere due to rising inflation. This covers the cost of commodities, services, housing, and other things. However, you secure your monthly mortgage payments when you buy a property, substantially protecting yourself from rising housing costs. Natalie Campisi, Advisor Staff for Forbes, stated that:

“Tangible assets like real estate get more valuable over time, which makes buying a home a good way to spend your money during inflationary times.”

The Bottom Line:

Real estate outperforms other assets and continuously improves in value over time. It is less susceptible to sudden changes than the stock market is. You receive a real, practical asset. It stands to reason that, even during times of heightened inflation, so many people consider it to be the ideal long-term investment. Investing in commercial real estate, multifamily structures, or single-family houses can yield substantial returns if you undertake the needed research. Real estate investing could increase your income, regardless of whether you are still debating if you should buy a home, wondering how to do so, or are ready to apply and purchase.

What To Do:

Did you find this read interesting? Need expert and white glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!