The experience of purchasing a home is very individualized and subjective. It may be influenced by various things for people. One thing to keep in mind is that it should be a deliberate choice. Evaluating the real estate market is the most important thing to do before figuring out how to buy a house. However, it may be difficult for you to determine whether you are ready to buy with all the noise and information around you. Take a look at what the data says to help you sort through the noise and provide you with the information you need most. And as you make your choice, consider the following questions:

What is the Outlook of the Housing Market?

The housing market has remained stable despite early worries of a crash comparable to the Great Depression. The market has cooled since its peak earlier this year. This is due to the effects of higher mortgage rates and recessionary fears. However, there are additional factors that could affect the market’s speed. This will favor conditions for both sellers and buyers. Market conditions are gradually becoming more balanced. It is less heavily weighted in favor of sellers. And for homes with appealing prices, buyers are still expressing interest. There is still maintenance of some level of competition.

What Direction Do I Think Home Prices Will Take?

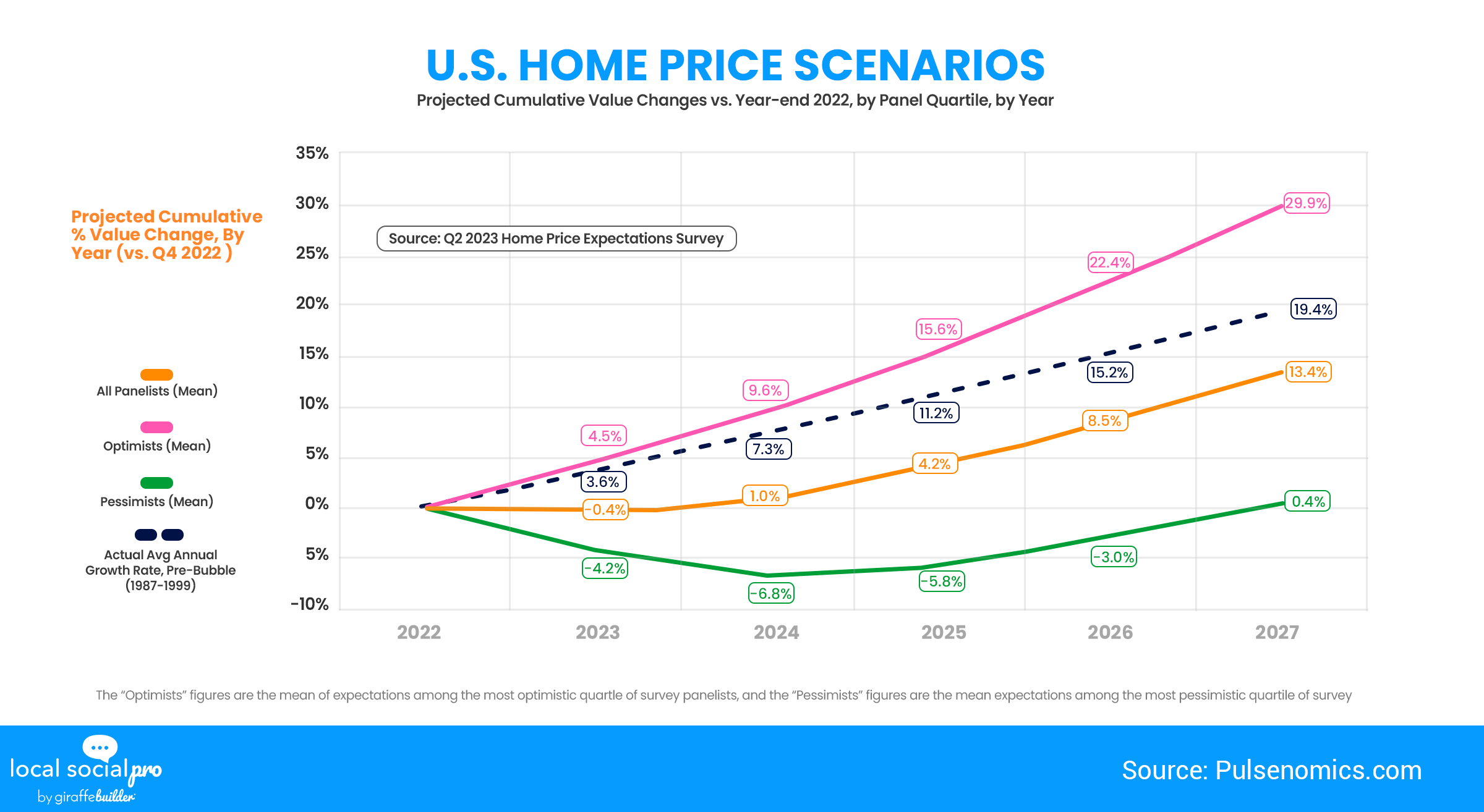

According to the most recent report, experts predicted a slight depreciation this year. What you really need is this context, though. The worst price declines in recent memory have already passed. In many markets, prices are even rising once more. Not to mention, the modest depreciation of 0.37% HPES predicts for 2023 is far from the crash that others predicted would occur.

Let’s now focus on the future. Following this year, the HPES predicts that home price appreciation will return to more normal levels. What makes this important to you, then? It implies that, but only if you buy now, your home will probably increase in value. Additionally, you will accumulate home equity in the years to come. According to these projections, if you wait, the house will end up costing you more in the end.

What Direction Do I See Mortgage Rates Taking?

An updated Commerce Department report indicates that the U.S. economy is expanding faster than anticipated. In the upcoming months, inflation will continue to be the primary factor influencing mortgage rates. Based on the most recent reports, we know that inflation, while still high, has moderated from its peak. This is a positive development for the economy and mortgage rates. This is why. Mortgage rates typically decrease as inflation slows.

The Bottom Line

Without a doubt, this is an excellent moment to buy a home. Just make sure your purchases are influenced by the right factors. And you are well aware of what is going on with the housing market right now prior to beginning your search. If you do, you’ll spare yourself a ton of hassle and money! Lean on a dependable real estate agent who can provide a knowledgeable assessment of your local market.

What To Do:

Did you find this read interesting? Need expert and white-glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional specializing in this topic and more!