Numerous individuals want to know how the market will look in 2023. Luxury real estate continues to be an exceptional case despite a slowing in demand and a rise in the amount of available inventory. This year, it is anticipated that strong demand for luxury listings and a dearth of builders will prevent prices from dropping significantly. Luxury real estate appears to be having a big year.

Expectation vs. Reality: 2022 Recap

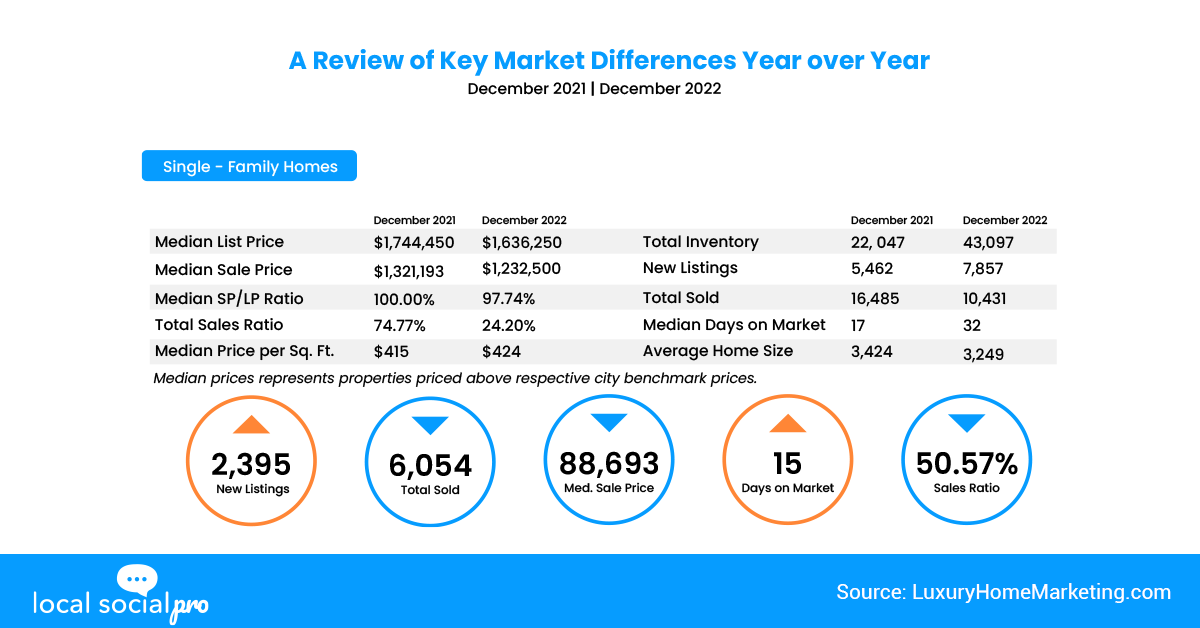

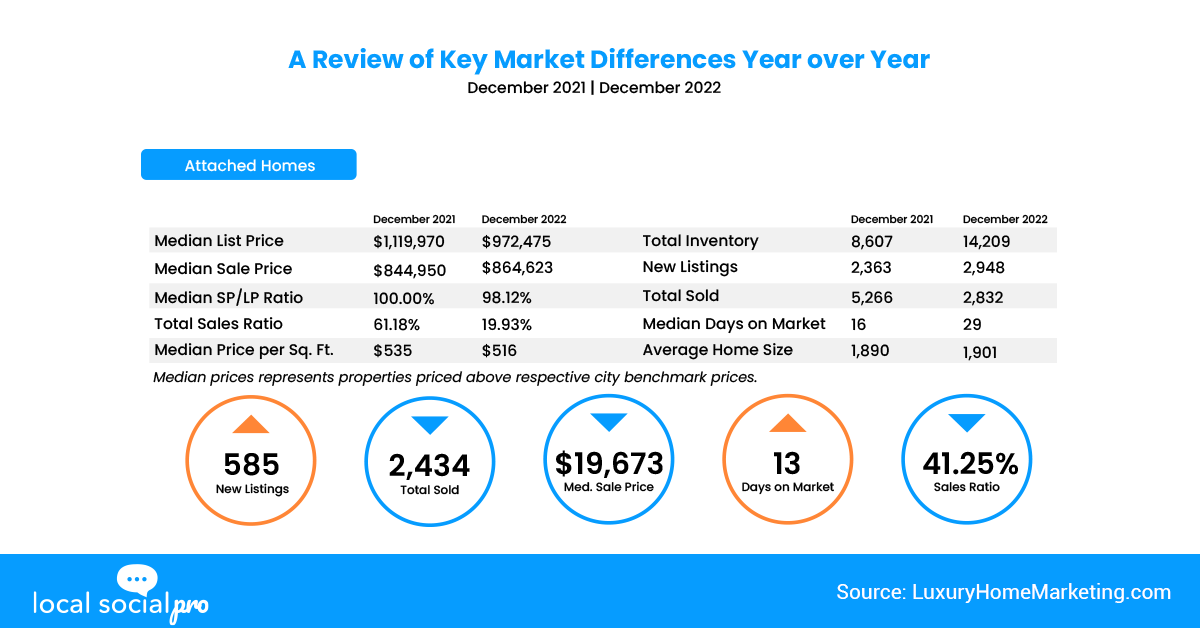

The year 2022 was expected to be calmer, with dependable trends, like the return of the spring housing market and higher inventory levels, helping to stabilize price increases. Although the 2021 frenzy was expected to be replaced by a more critical assessment of the property’s value, it was still predicted that demand for luxury properties would remain strong. What was unexpected was the impact of factors like Ukraine, inflation, interest rates, as well as recession rumors, which led to a year of dilemmas, uncertainty, and unanticipated outcomes. Nevertheless, in spite of all these mitigating circumstances, the luxury real estate market as a whole remained resistant to any significant or unfavorable change and continues to appeal to the wealthy as a secure investment. Despite the fact that sales activity has continued to slow down over the past quarter, prices in the majority of luxury markets have not just remained stable but are also at almost record highs.

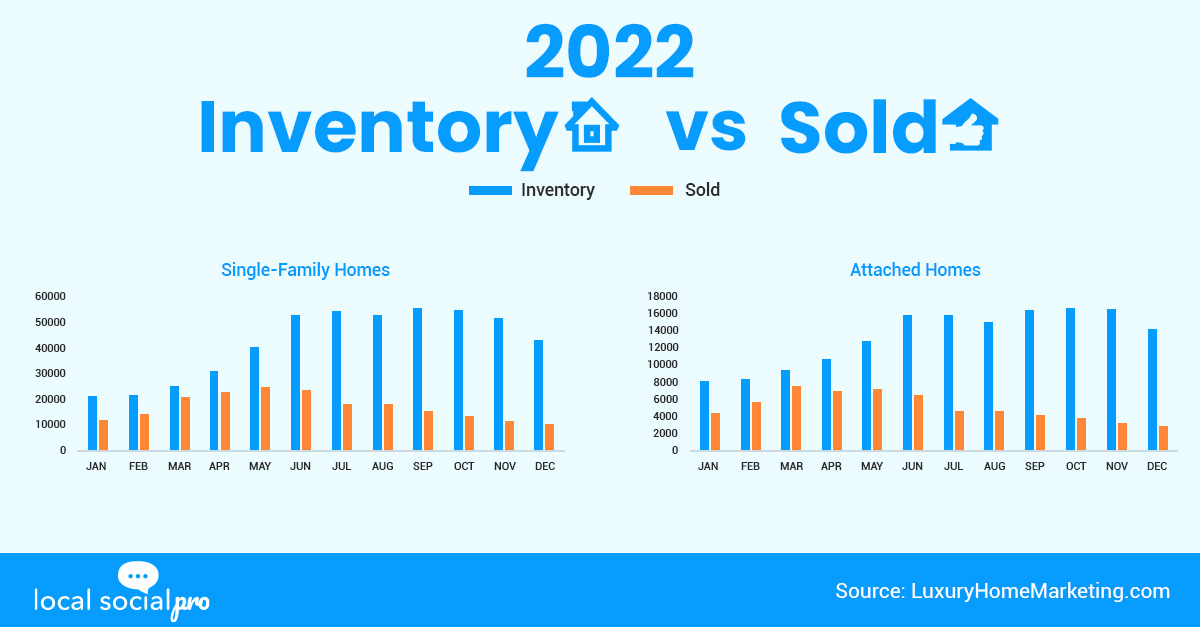

The Role of Inventory in the Luxury Market

In the market for luxury properties, inventory is essential, particularly new inventory. Due to its absence, prices were able to remain stable and many markets continued to favor sellers. As a result, by the end of 2022, the market was completely stagnant. Due to what they observed, luxury sellers decided against entering the market. Buyers were hesitant because of rising interest rates and inflation, and they were concerned that they wouldn’t get the same price as their neighbors had the year before. By the third quarter, luxury home sellers were reluctant to list their properties because they were hesitant to sacrifice their low-interest rates. This was due to interest rate increases. Jim Egan, the U.S. housing strategist for Morgan Stanley, states that “Over 90% of the market is a fixed rate, for one. Most people have locked in their affordability.”

Impact of External Factors on the Luxury Market

According to North America Luxury Review, there are 3 variables that significantly contributed to the slowdown in sales.

-

Interest Rates

- The rise in interest rates has generally less of an impact on luxury buyers. However, the sharp increases in 2022 led to potential sellers opting not to list their homes because they realized that if they obtained a mortgage on a new property, their interest payments would double.

-

Stock Market

- Luxury buyers became more circumspect as a result of stock market corrections, especially if they planned to leverage their equity holdings. Many real estate investors hid out and awaited the return of stability during the downturn, which started with adjustments of more than 10%.

-

Inflation

- Wealthy sellers and buyers had another reason to hesitate due to rising inflation and persistent recession forecasts. Those who didn’t need to sell didn’t, and buyers were hesitant to commit out of concern that they would overpay due to the high level of uncertainty and speculation surrounding the potential effects on home values, particularly in the last 6 months of the year.

Luxury Real Estate Continues to Draw Strong Interest

Buyers are still keen to invest in luxury properties despite the effects of these outside factors, mainly if they can negotiate better terms. If a property is priced correctly, has a unique appeal to an existing buyer, and most importantly, is move-in ready—a demand that remains high on the prerequisites for most buyers—properties are still selling. Over the past six months, cash buyers have increased again; before, only the very affluent were reaping the benefits of the historically low-interest rates. Due to the transaction’s lower risk and reliance on cash rather than a bank or other institution for funds or change, sellers are eager to work with cash buyers in today’s market. Many wealthy buyers may view using their cash as a short-term strategy. However, with an eye on the long-term investment opportunities of their luxury property, they will eventually refinance, particularly when interest and loan rates start to move lower.

Future Predictions

We anticipate that the luxury real estate market will remain softer than it was in 2017, though it’s crucial to keep in mind that the market is simply returning to normal. Expect properties to remain on the market for a longer period of time, prices to remain relatively stable, and wealthy people to make decisions based on long-term investment. According to Coldwell Banker, a growing number of wealthy people seem to be drawn to real estate as a means of achieving psychological, emotional, and financial stability.

The Bottom Line

The main takeaway from 2022 is that market corrections can occur quickly. As a result, making investments in real estate, particularly luxury properties, over the long term is essential. To determine what is actually happening in your local market in this unusual market, consult a local expert. In this market, selling and buying require a critical and structured approach; recognizing the facts and adjusting expectations will help people achieve their objectives.

What To Do:

Did you find this read interesting? Need expert and white glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!