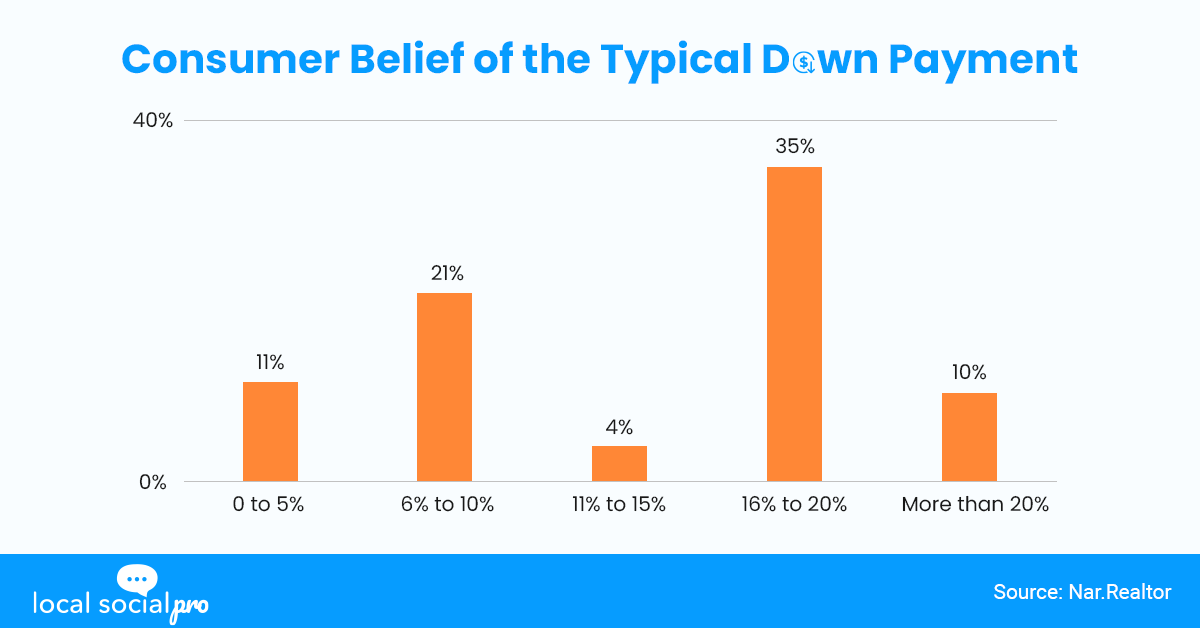

Acquiring an affordable down payment is one of the biggest obstacles to homeownership. Numerous factors have been found to be deterring Millennials from buying homes at the same rate as older generations. A recent survey shows that 39% of renters said they thought a 20% down payment would be required in order to qualify for a mortgage. The average mortgage down payment was actually only 5%. According to the National Association of Realtors, first-time home buyers typically put down 7% of the purchase price. For repeat buyers, the typical down payment was 17%. While it’s true that many lenders use a 20% down payment as the minimum threshold for amending mortgage insurance on conventional loans, this is not the actual requirement.

People don’t think of themselves as candidates for homeownership when they actually are, according to Laurie Goodman, co-director of the Housing Finance Policy Center at the Urban Institute.

“Even in areas of the country where it is much cheaper to buy than to rent, people think, ‘I can’t afford to buy,’ because they don’t have the necessary down payment. Whereas, in fact, given where down payments actually are, they do. It’s a huge deterrent.”

Irrefutably, a larger down payment is preferable given all other factors being equal. However, if you take out a mortgage when rates are high, it becomes more difficult to justify the math. If you make a smaller down payment than 20%, you might be subject to a higher interest rate because some lenders consider loans with less equity to be riskier. You and your lender will have some protection if home values decline if you start with more equity. Building equity is a major justification for why it makes sense to become a homeowner early. The average homeowner has a net worth of $231,400, which is 44 times greater than the average renter’s net worth of $5,200, according to the Federal Reserve’s Survey of Consumer Finances. The more equity you can accumulate over time, the earlier you purchase. In case of an emergency or retirement, you can draw on that equity.

The Bottom Line

Your objectives and financial circumstances will determine the appropriate down payment for you. When you take into account how much you’d be paying in rent each month, waiting until you’ve accumulated a 20% down payment can result in a significant loss of opportunity. In the long run, purchasing a home now might be more affordable than continuing to pay rent while putting aside money for a 20% down payment. The choice ultimately depends on your motivation, your self-discipline, and your financial capacity.

What To Do:

Did you find this read interesting? Need expert and white glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!