Summer has finally arrived. Aside from the scorching heat, there is something hotter that everyone seems to be concerned about: Inflation. The economy has changed dramatically since the beginning of the year, as COVID restrictions were lifted, the Federal Reserve hiked interest rates, and global markets were rattled by Russia’s invasion of Ukraine. Inflation is rising at its quickest rate since the early 1980s, due largely to rising energy, transportation, and food expenses, as well as rising housing prices. When it comes to the housing market, it’s reasonable to say we’re in the midst of the country’s hottest period in history. What impact does this have on the real estate market?

Real Estate experts predict that inflation will continue to rise throughout the year. But before we become too dismayed, there are approaches to mitigate the effects of inflation, particularly if you are planning to purchase a property during these difficult times. Despite inflation, here’s how you can stay “cool”:

1. Have a change of mindset

Chairman of the Federal Reserve, Jerome Powell, stated that something needs to change in order for more people to begin climbing the real estate market.

“I would say if you’re a homebuyer, or a young person looking to buy a home, you need a bit of a reset,”

Experts explained that his comment about mortgage rates being “above” normal means that, while recent rate hikes have occurred, we shouldn’t anticipate this to be the new normal in the long run. Mortgage rates were higher in the past, according to historical data. Although we can’t really predict how it will affect home sales and demand immediately, our viewpoint and how we see things influence how we make the right choices in our real estate venture. As uncertainty has become a constant in today’s world, everyone must be well-prepared as we observe a shifting housing market and always hope for the best.

2. Expand your options

Due to persistent low inventory, housing prices are still high. According to a Bankrate poll taken earlier this year, approximately two-thirds of non-homeowners (64%) believe affordability is preventing them from purchasing a home. This includes 43% who believe their earnings are insufficient, 39% who believe property prices are too high, and 36% who cannot afford the required down payment or closing costs. Whilst the affordability crisis is pervasive, it is critical to make concessions and widen our options in order to save money or secure our ideal homes. Here are options you can consider:

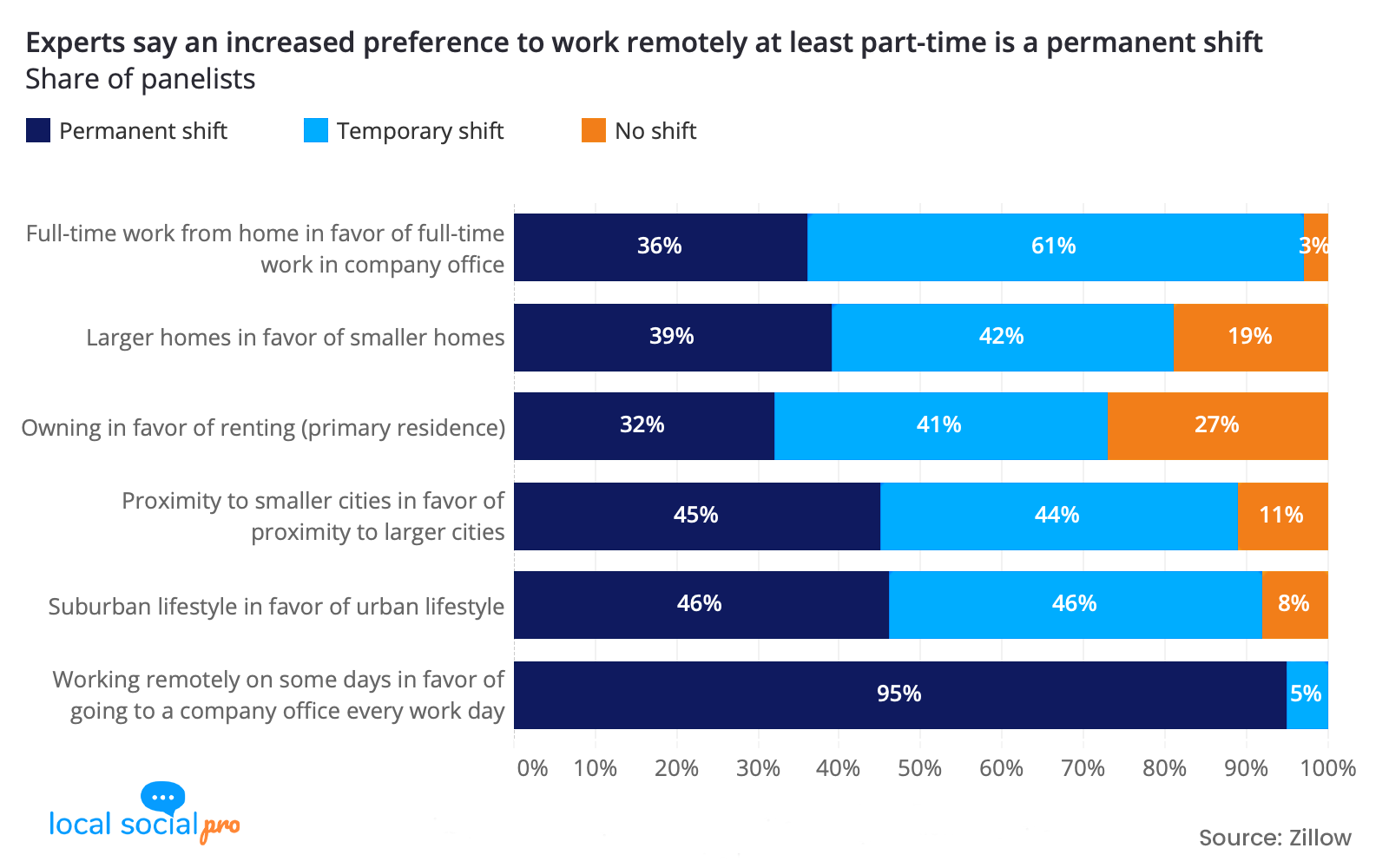

- With the advent of remote work, it may be necessary to reconsider your geographical boundaries. Moving to a less costly neighborhood such as the suburbs, or even buying a fixer-upper are examples of these actions.

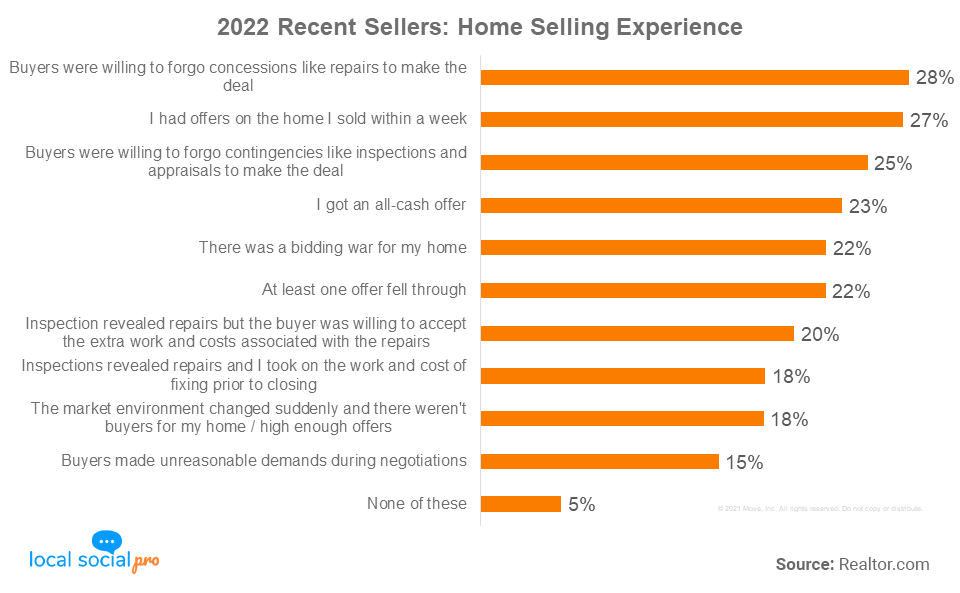

- To have a higher buying power and to help close the deal, statistics show that over 25% (Gen X, Millennials, and Gen Z) of buyers were willing to waive inspections and appraisals.

3. Take control of your credit score

According to a recent survey conducted by Zillow, population in the US generally have a poor understanding of credit scores, which is a significant disadvantage given that having a good credit score is significant now more than anything. In a more complex and costly environment, qualifying for the lowest feasible interest rates will keep your monthly expenses to a minimal. Maintaining a good credit score will help you get the best mortgage rate and minimize your monthly payments. Paying off loans, avoiding delinquencies, and addressing any inconsistencies on your credit history can all help you maintain a high credit score. It’s imperative to get your finances under control and improve your financial picture in order to be in the best position possible even if property values fall over time.

The Bottom Line:

Purchasing a home in a high-inflation market is not impossible. There is no such thing as a perfect time to invest in real estate; it all depends on your personal preferences and can be situational. If the statistics work for you right now and you can acquire a mortgage with monthly payments you can manage in the future, now is a good move to purchase. However, pay more attention to economic risks. The better prepared you are for your home purchase, the more likely you will succeed. You may ensure that you keep your cool in this “extraordinarily elevated” inflation by preparing ahead, managing your time, and getting expert advice.