What is a Home Equity Line of Credit or HELOC?

A home equity line of credit (HELOC) is a loan that lets you take out money, spend it, and pay it back over time using the value of your house as security. Like a credit card, you can use a home equity line of credit to borrow money and pay it back in whole or in part each month. You can borrow money with a HELOC by using your equity, which is the value of your home less the balance of your primary mortgage. If you own your property outright, you can still obtain a HELOC; however, in this case, the HELOC acts as your primary mortgage instead of a secondary one. Borrowing against the value of your home will frequently result in the best interest rate when you shop around for a loan.

How Does HELOC Work

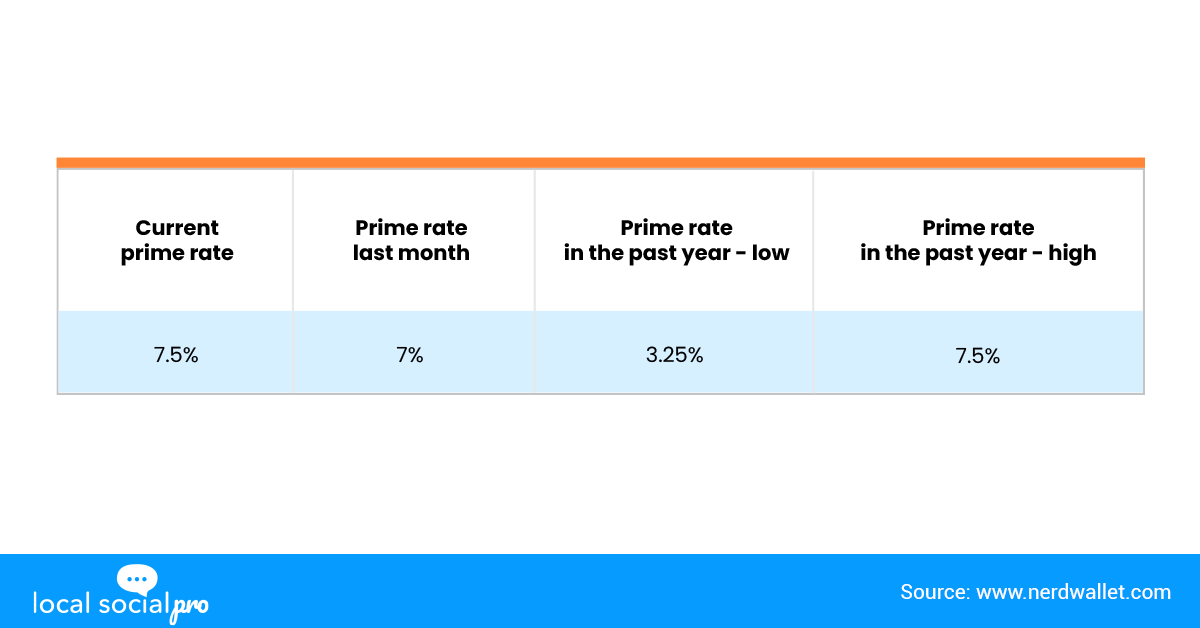

The majority of HELOCs offer variable interest rates. This implies that your HELOC’s interest rate will change along with changes in the benchmark interest rate. The interest on a HELOC is, however, generally closer to a mortgage rate than it is to a credit card rate because it is protected against the value of your house. The lender will begin with an index rate to determine your rate, then add a markup based on your credit profile. The markup is typically lower the greater your credit score. Before you approve the HELOC, you should request to see the amount of the markup, or margin.

A HELOC goes through two stages:

- The time frame during which you may withdraw funds from the account up to your authorized limit.

- The time frame during which you are required to repay all money you have already withdrawn and are not permitted to withdraw anymore.

You can use designated checks or a draw card to access funds from the HELOC during the draw period. The funds in your HELOC are replenished as you repay it, but you will need to pay monthly interest payments on the sum you borrow. The average length of this draw period is 10 years.

Should You Get a HELOC?

HELOCs are generally a good choice for some types of projects. For a lengthy home improvement or repair project, you might be able to take out a sizable loan with a low-interest rate, or you could keep the credit line open in the event of an emergency. To be eligible for a HELOC or to receive a low-interest rate, you might also need a good credit score. Additionally, HELOC fees may be higher than those for some other kinds of credit accounts. You should think about how the HELOC market and increasing interest rates might affect your decision.

- Increasing interest rates: A HELOC might be preferable to a cash-out refinance as interest rates rise. The interest rate on your HELOC, however, can also change as interest rates rise. Examine whether a fixed-rate loan would be more advantageous.

- Accessibility: A few major financial institutions that stopped providing HELOCs at the beginning of the pandemic haven’t started up again. To ensure you’re receiving the best deal, you should still shop around. Be aware, however, that there might be fewer options and that a high demand might result in lengthy application processing times.

- Rising housing costs: As housing costs rise, your home’s equity will increase. Accepting below the maximum allowed may allow you to obtain a lower rate or a credit limit that is higher. However, keep in mind that prices do not often rise. If you borrow a lot, you risk being underwater if the market declines (owing more than the house’s value).

The Bottom Line

The more you do your research, the best deal you will obtain. Get quotes from different lenders as you search for the best HELOC rates. Check with your mortgage or bank provider; they may provide discounts to current clients. Obtain a quote and contrast the lender’s rates with those of at least 2 other lenders. As you compare prices, keep an eye out for introductory deals such as initial rates that end after a certain period. Your goals and financial situation will ultimately determine whether a home equity line of credit is a good idea. If you are still wondering if it’s the best decision for you, your local expert is the one who can give you professional advice so you can make the best one.

What To Do:

Did you find this read interesting? Need expert and white glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!