It’s vital to be aware of widespread myths if you intend to buy or sell a home. There’s a big possibility that you’ve seen or heard some reports about the real estate market that don’t reveal the whole story. This notion can give buyers and sellers the wrong impression, confuse or misinform them, leading to poor decisions about purchasing or selling a home.

Real estate is constantly changing, and it can be challenging to distinguish reality from fallacies. Whether you’re a buyer timing your purchase based on property prices and mortgage rates or a seller understanding what to improve or fix before listing your home, this is where a reliable real estate expert can lend a hand. They can assist in refuting falsehoods in the media so you can comprehend the market today and what it signifies. As Henry Ford once said,

“We live in an era of tremendous facts. And the facts are facts. They are also unpleasant facts, which does not decrease their factual percentage one bit. Our job is to understand them, to recognize their presence, to learn if we can what they signify and not to fall into the error of minimizing facts because they have a bitter flavor.”

To clear up any misconceptions and perhaps assist you in making more educated decisions about your real estate venture, we’ve listed the most prevalent myths in the real estate market.

1. Myth: For Sale by Owner is better than hiring a Real Estate agent.

Fact: Although for-sale-by-owners have genuine intentions, they generally lack knowledge. We’ve all seen and heard justifications given by FSBOs as to why they believe they can sell their properties without the assistance of a real estate agent. A lot more people try to sell their homes without the help of a real estate agent, but very few are successful.

According to research, sellers believe they:

-

Can reduce costs (57%)

-

Conserve time (36%)

-

Better than any agent at knowing their house (27%)

A Zillow study found that 36% of FSBOs attempt to sell their houses without an agent, but many encounter difficulties and ultimately hired one. Approximately 11% of sellers finish the transaction successfully. In 2020 statistics, FSBOs accounted for 7% of all house sales. The average FSBO home sold for $260,000 as opposed to $318,000 for property sales with agent assistance. All the statistics provided have proven that sales prices for homes secured by agents are generally better than those obtained by comparable FSBO listings, which is also sufficient to cover the commission fee agents receive for their expertise. Homeowners who sell with an agent make about the same money, if not more, and experience significantly less stress than those who try to do it on their own.

2. Myth: Wait until housing prices and mortgage rates drop before making a purchase.

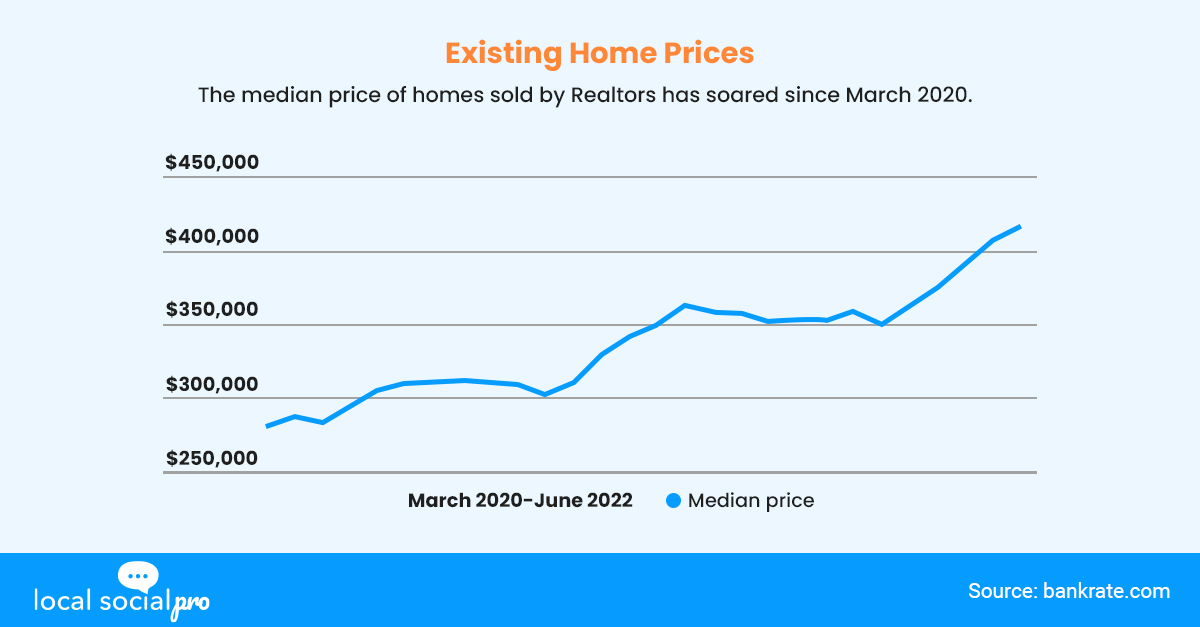

Fact: To argue that the home prices today are experiencing inflation would likely be an understatement. Although analysts predict that the changing market would slow the price rise, they remain to anticipate ongoing appreciation. As a result, home prices won’t decrease. Despite the fact that inventory is rising as the market cools, there is still a shortage of supply. Lawrence Yun, the chief economist for the NAR said that although home price growth may slow nationally, it won’t decline. Even when the market cools, the imbalance between supply and demand persists.

The urge for taking action sooner rather than later is strengthened by rising mortgage rates. As the Federal Reserve follows with its plans to implement numerous rate hikes this year, rates may rise more than they did at any point. While there is a risk that home prices could drop, they also have the potential to increase. It becomes evident that waiting to buy involves some risk when you combine that with a consistent increase in mortgage rates. Supply and demand will still be the main determining factors in pricing, so higher mortgage rates may not necessarily result in reduced prices, but they may make life a little easier for buyers.

“Nevertheless, with demand remaining considerably beyond the available inventory, the pressure on home prices will remain strong, particularly as potential buyers fear further increases in mortgage rates.”

Selma Hepp, deputy chief economist at real estate data firm CoreLogic.

3. Myth: The Housing Market is about to crash.

Fact: In contrast to the 2006 housing market, where high housing prices were caused by loose lending standards and unrestrained investor speculation, the market now is significantly different. There are numerous factors that make it appear as though we are in a bubble, but at its core, the problem is straightforward: supply and demand are increasing prices. The majority of the market is made up of existing residences, although their supply is also declining. A portion of that is due to the buyers’ struggles with affordability. According to a Discover Home Loans survey, 79% of homeowners choose to renovate rather than relocate.

Since many buyers believe that the market is now in a bubble, they might be inclined to hold off on purchasing a home until an economic meltdown renders them more accessible. Experts advise against holding out hope for that. Instead of waiting for the market to crash, here are some tips for handling the recent housing market:

-

Strive to find a mortgage – When it comes to bidding on properties, buyers may not have much bargaining leverage, but you may search extensively for the best home loan. Obtaining several loan offers can result in thousands of dollars in savings over the course of the loan.

-

Enter the bidding process prepared – You might be tempted to increase your offer in an effort to win when the going gets tough. Set a clear upper limit on the amount you’re willing to give for the property before you enter a bidding battle, and cling to it.

-

Avoid skipping inspections at any costs – In order to compete, many homebuyers have consented to release sellers from responsibility for any problems discovered by a home inspector. Don’t skip the inspection if you decide to take this route.

In this time, being strategic is key. Market cycles frequently include corrections. Being patient is different from waiting for the market to crash. Therefore, the best course of action during one is to maintain your position. Don’t let fear influence your investment choices; instead, stay true to your goal.

The Bottom Line:

The complexity of the real estate market is only increasing over time. Many people wish to sell or buy homes and think the procedure will be easy, but they are completely misinformed. Regardless of the hearsays and news about the housing market, it is better to trust the professionals and work with a local real estate agent. You’ll have an experienced expert on your side who is knowledgeable about the market’s openings and breakaways, present patterns, and historical context. Furthermore, you have a likelihood of success in your real estate ventures. As you get your facts straight, we’ll conclude you with this quote from Henry Ford:

“Thinking calls for facts; facts are found by digging, but he who has gathered this wealth is well equipped for life. ”

What To Do:

Did you find this read interesting? Need expert and white glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!