Owning a home offers many financial advantages, and one of the most powerful is building equity. Today, homeowners across the country are sitting on record levels of home equity—and this could be a game-changer for your financial future. Let’s explore what home equity is, why it’s such a big deal, and how it can fuel your next move.

What Is Home Equity?

Home equity is the difference between the current value of your home and the amount you still owe on your mortgage. For example, if your home is worth $400,000 and your mortgage balance is $200,000, you have $200,000 in equity. This financial cushion grows as you pay down your mortgage and as your property appreciates in value.

Why Home Equity Matters

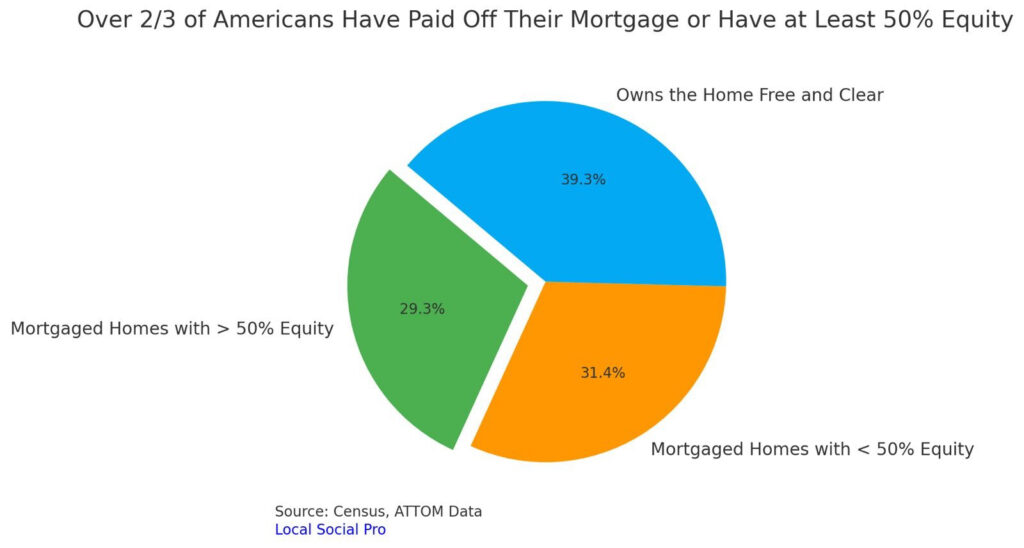

Recent data shows just how significant today’s home equity levels are. According to ATTOM and the U.S. Census Bureau, more than two-thirds of homeowners have at least 50% equity in their homes or have paid off their mortgages entirely. On average, CoreLogic reports that homeowners have $311,000 in equity. This kind of financial leverage opens up incredible opportunities, especially for those looking to sell their homes.

Here’s why that equity is such a big deal:

Opportunity to Buy Your Next Home in Cash: For some homeowners, their equity is substantial enough to purchase their next property outright. This eliminates the need for a mortgage, saving you from monthly payments and interest—a particularly attractive option in today’s high-interest-rate environment.

Larger Down Payment Options: Even if you don’t have enough equity to buy your next home in cash, you can use it to make a significant down payment. A larger down payment often results in better loan terms, lower monthly payments, and less financial stress overall.

Greater Flexibility for Life Changes: Your equity can be a financial safety net, giving you more options to relocate, downsize, or upsize, depending on your lifestyle and needs. It’s a financial tool that can help you adapt to life’s changes with confidence.

How to Tap Into Your Equity

Before you can unlock your equity’s potential, you need to understand how much you have. This is where a professional equity assessment report (PEAR) comes in. A real estate agent can provide you with this report, which details your home’s current value and your equity amount. From there, your agent can help you strategize your next steps.

For example, if you’re considering selling, they’ll guide you through pricing your home competitively and using your equity to achieve your goals—whether that’s buying your next home or investing in other opportunities.

Bottom Line

Home equity is more than just a number; it’s a powerful tool that can transform your financial future. Whether you’re planning to move, invest, or simply explore your options, understanding and leveraging your equity can make all the difference. Ready to find out how much equity you have and how it can work for you? Connect with a local real estate expert today to take the first step toward your next big move.