People who carefully plan for big purchases are less likely to experience financial difficulties in the future. Most especially in buying a home. So let’s make a plan if you’re considering buying a house this year. Checking your credit is the first step. Your credit score is crucial when you’re buying a home since it provides a history of how you’ve managed debt. A good credit score also makes the home-buying process simpler and more affordable.

What is a Good Credit Score?

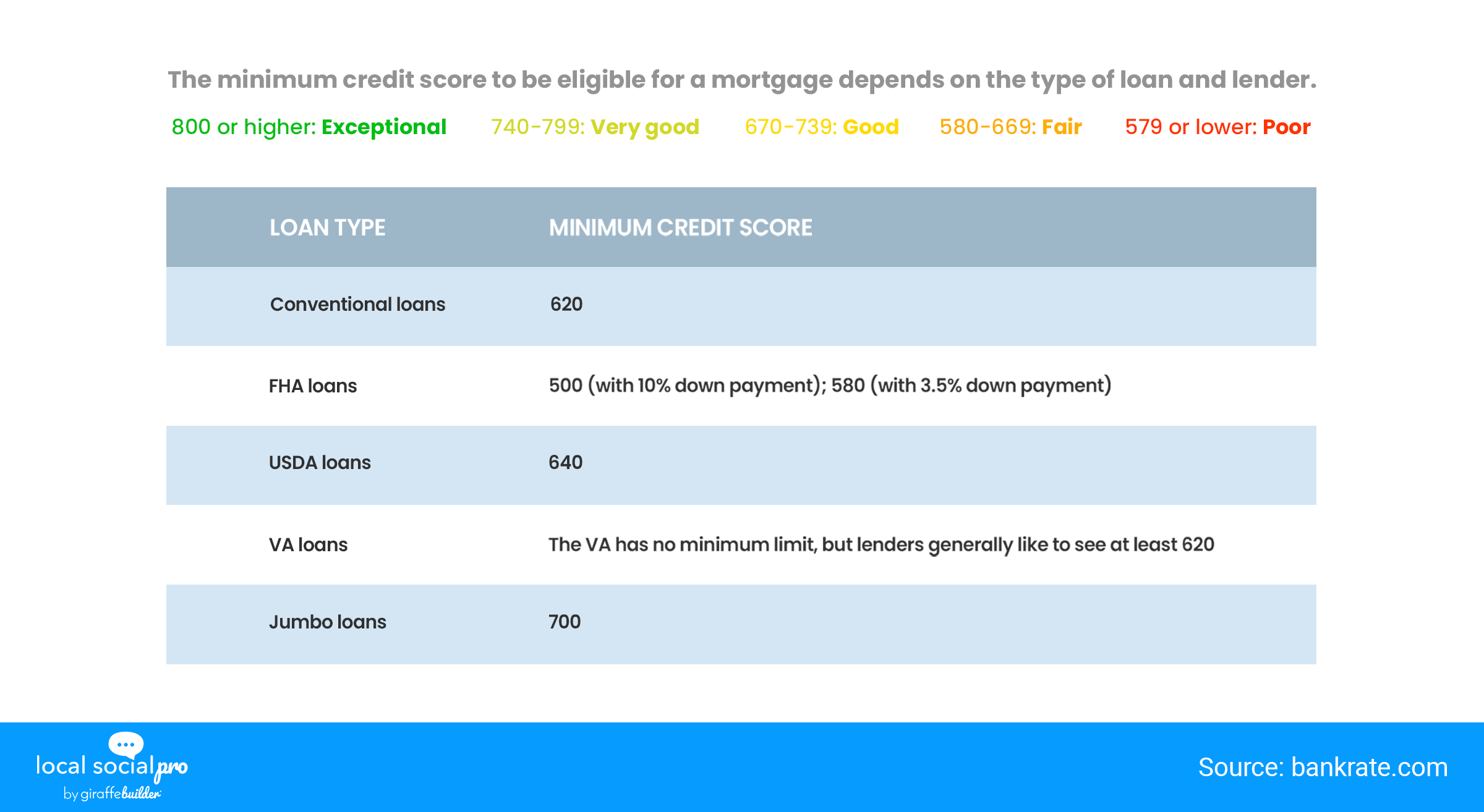

Your mortgage request will determine the answer. You will probably require a score of at least 620, according to Bankrate. For most lenders, this rating is “fair” in order to qualify. There isn’t a single, standardized credit score that will guarantee your eligibility for a mortgage. However, lenders have minimal standards for credit scores.

Many lenders rely on the FICO (Fair Isaac Corp.) model for credit scores when deciding the best credit score to purchase a home. It grades consumers from 300 to 850, with a higher score showing a lower risk to the lender.

Your Credit Matters

Lenders will use your credit scores to determine whether they are able to lend to you. They will also depend on it to see the applicable interest rate for you. Don’t request more credit than you actually require. As much as possible, refrain from opening new accounts or increasing your debt. If you apply for too many new accounts or incur too much new debt, your credit score may suffer. Additionally, if the conduction of additional credit checks are within a 45-day window, they won’t harm your credit.

The Bottom Line

Keep in mind that everyone has the right to shop around for the best mortgage. Regardless of their financial situation and credit score. You will be in the best position to obtain a mortgage by checking your credit history. Also, make sure to correct any errors, and be aware of your credit scores.

What To Do:

Did you find this read interesting? Need expert and white-glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional specializing in this topic and more!