The market evolves—particularly those of the kind and magnitude we’ve witnessed over the past few years can be contentious and frightening, especially for those who are more recent entrants to the field. The real estate market has been an extremely challenging place in recent years, with many investors uncertain of where to turn in order to capitalize on opportunities. However, there are still some ways to find unexpected opportunities even in a difficult market. The time has come for individuals to change their focus and mindset in order to take full advantage of the market’s current opportunities and advantages.

The Challenges for Real Estate

All real estate markets are currently affected in the near future by rising inflation concerns, rising interest rates that are expected to surpass 8%, the high cost of housing, a persistent recession, and uncertain political conditions. Although the subject of “Real Estate Market Crash” saw an increase in online search results of 284% in September, according to Google Trends, many believe the market’s reversal will be much less dramatic. Zillow Report forecasts that metros in the South and Midwest will experience the least significant declines over the coming year except for vacation and second-home markets.

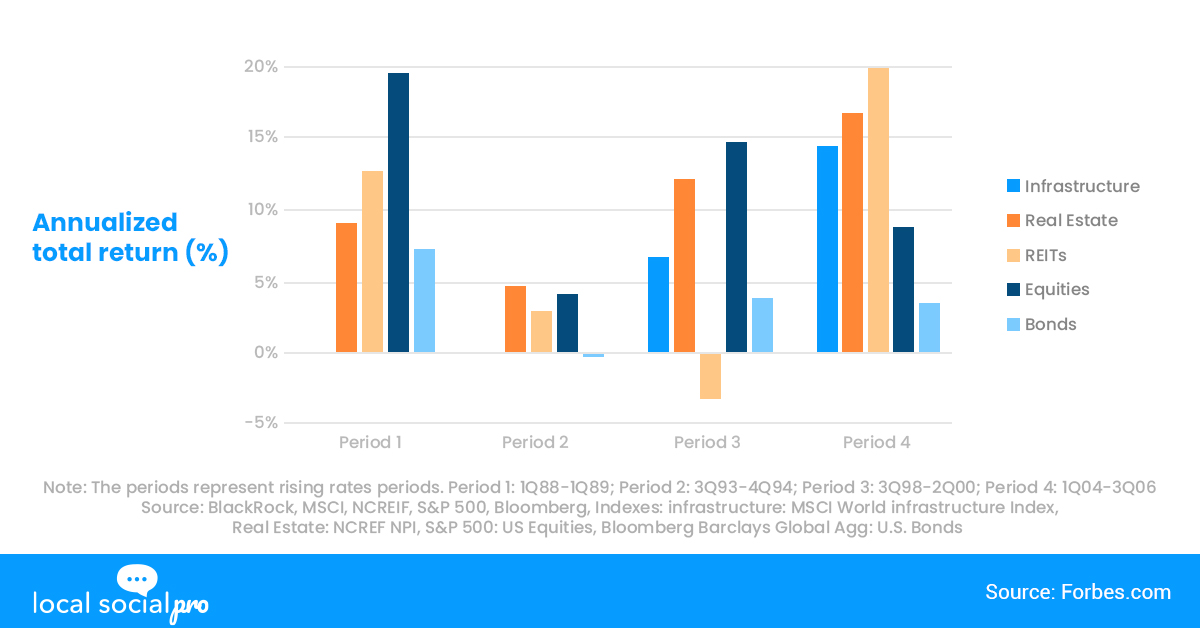

As per Forbes, increasing interest rates can indicate a healthy, expanding economy, which frequently implies that real estate is anticipated to continue to perform well. The U.S. economy has, however, benefited from historically low-interest rates for years. A sudden or significant increase in rates could reduce the amount of capital available for commercial real estate development, which could jeopardize some real estate-based initiatives.

The Opportunities For Real Estate

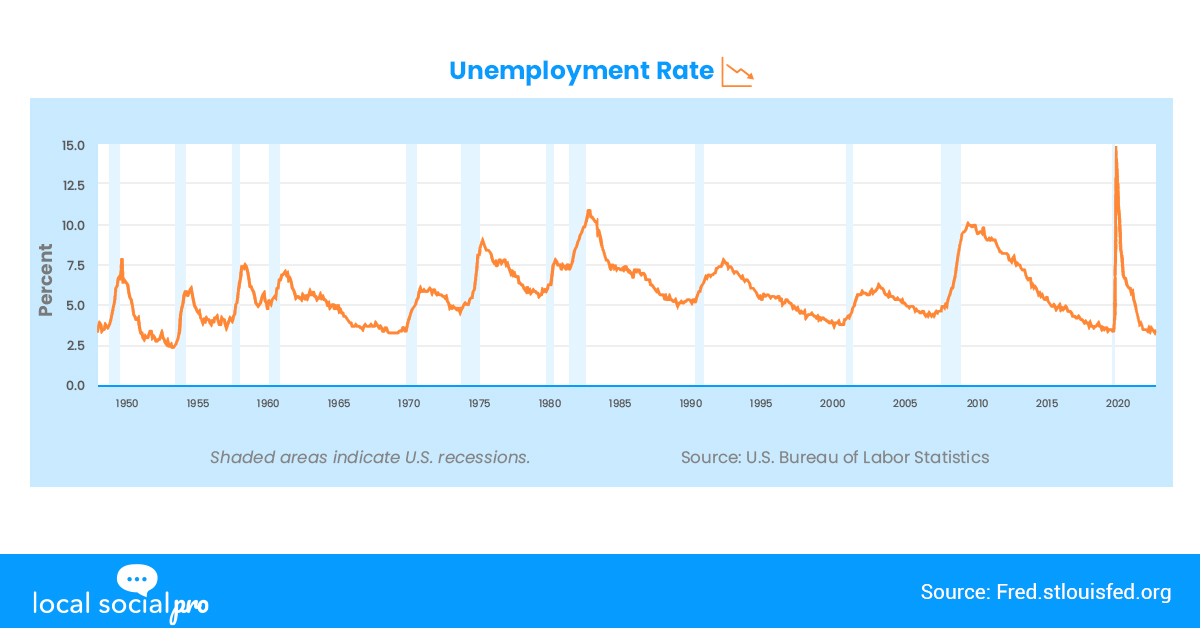

As evidenced by the national unemployment chart, which shows that unemployment has been kept below the 5% threshold, wherein economists have historically regarded it as a sign of “full employment,” for more than a year. If this pattern persists, it is likely that more companies will need real estate, which could be advantageous for REITs that own commercial properties like office buildings, factories, and other places where a company’s employees are housed.

According to a recent article published in the Washington Post, millennials are currently the largest generation still alive. Because of their sheer numbers, Millennials are expected to drive up demand for office buildings and other types of commercial real estate as they become more independent, enter the workforce, and rent their own apartments.

Given that many macroeconomic indicators point to continued strong fundamentals and solid growth in the commercial real estate market (with some hiccups along the way), investing in a diversified real estate portfolio made up of a variety of commercial properties and managed by a team of professionals represents a potentially viable option for some of your investment funds.

With the right strategy and mindset, you can open yourself up to a world of possibilities. Be willing to take a chance. Many investors become too comfortable in their current position and don’t consider taking a risk with new investments. However, taking a chance on something that may not be a sure thing can lead to unexpected opportunities. Consider investing in a property that is in a less desirable area or that is in need of some repairs. These properties may be less expensive, and if you are willing to put in the work to make the property livable, you may be able to turn a profit. Second, research current trends. The real estate market is constantly changing, so it’s important to stay up to date on the latest trends. Research areas that have seen an influx of buyers or investors, or consider investing in a growing neighborhood. You may be able to capitalize on these trends and turn a profit. Lastly, consider alternative investments. Investing in real estate doesn’t have to mean buying and selling property. Consider investing in a REIT or in a real estate crowdfunding platform. These investments can provide a steady income stream without the hassle of dealing with tenants or repairs.

The Bottom Line

Real estate is changing quickly; it is cyclical and anticipated, though it can be difficult to consistently predict the catalysts. People who can quickly adapt to changes and foresee them are always more likely to succeed. Finding unanticipated opportunities in a competitive real estate market can be challenging, but it is possible with the right strategy. Research current trends, think about alternative investments, and be willing to take a chance. You should also keep an eye out for new opportunities. With the help of these suggestions, you can find unanticipated opportunities in a competitive market and make money.

What To Do:

Did you find this read interesting? Need expert and white glove advice? Get in touch for local and professional real estate advice in your neighborhood. Fill in the form above to speak with a real estate professional that specializes in this topic and more!