The decision of whether to sell or maintain the family home is one of the most pressing issues facing those who are close to retiring. You could incur large expenses or make substantial savings depending on whether you decide to move or stay in place. According to a recent survey by the Employee Benefit Research Institute, 70% of retirees would suggest altering current saving practices by starting to save or investing earlier. A lot of retirees lack a structured financial strategy for their retirement. Only 4 out of 10 seniors surveyed had created a written financial plan and stated their financial objectives for retirement.

Objectively speaking, the main goal here is to ensure that your finances are in order if you plan to retire, spend time with your grandchildren, and go to all the places on your wishlist. So here’s a way to make that happen: sell your home. Here are three factors as to why it is a wise retirement decision:

1. Increased budget, lower expenses

The most straightforward way to release the value you’ve built in your home is to sell it. The “4 percent rule” is a well-known general principle that serves as a baseline for estimating how much of your retirement funds you can confidently spend each year. If you sell your present home, you can increase your 4% ratio by investing some of the proceeds in a less expensive home and putting the balance into your retirement fund. Additionally, it might provide you more time to look for a place with reduced living expenses and taxes. Downsizing your home includes cheaper utility and maintenance expenditures, which could expand your income.

2. Leaving behind an asset for your family and not a mortgage

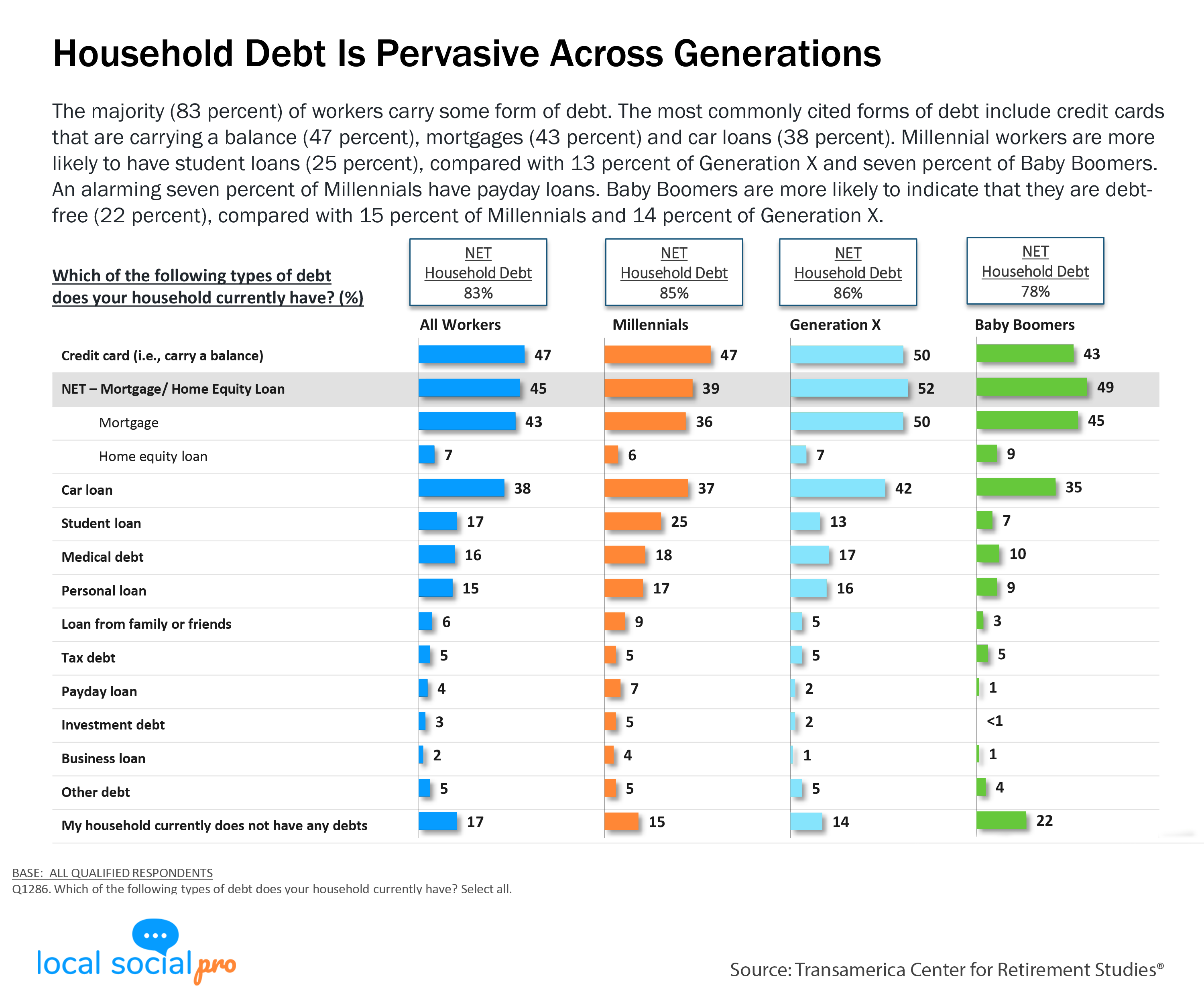

When making retirement plans, it’s important to consider how your family may be affected if you pass away. One of your most valued assets in terms of money is probably your home. If you carry a mortgage into retirement and something unfortunate occurs to you, you’ll be leaving your remaining family responsible for making payments until your house is sold. According to a recent survey by Transamerica Center for Retirement Studies®, mortgage or home equity loans are a prevalent form of household debt across generations ( All workers, Millennials, Generation X, and Baby Boomers). To avoid this, you can make sure that you leave them with a substantial asset by selling your house in return for a home that you can pay for in cash. By stating the property transfer in your will, you can pass down your new home to your children with less tax liability.

3. Best for your health and lifestyle

You might not be able to do things the way you do or function as well as you can now in the coming years or so. It’s a reality of life that as you become older, your body will deteriorate. At this point in your life, your must-haves are probably different from what they were when you were younger. Skipping stairs, living close to a decent hospital, and being close to family and friends who can help you if you experience health issues in the future are now much higher priorities. You may want to relocate to pursue your interests, such as skiing, golfing, somewhere near the seaside, or to an area with more pedestrians.

Selling your existing house to fund your retirement allows you to move into a more accessible residence where you may age in comfort. A terrific way to meet others in your same stage of life or who share your interests is in retirement homes or planned communities for seniors. This will give you a sense of belonging that will make your retirement the happiest.

The Bottom Line:

When you finally decide to sell your home after retirement, you will make the most of your important asset. You will avoid paying housing-related charges like HOA dues, property taxes, home insurance, maintenance costs, utility bills, tax liability, etc. Take your time deciding what’s best for you because it’s a life-changing decision. In the end, consider what fits best in light of your home equity and future goals. The earlier you start saving for retirement, the more thoroughly you can arrange the sale of your property. If you prepare ahead, you can sell when the market is favorable, and home prices are rising. If you take your preparation a step further, you might build a detailed plan to get you to your ideal retirement destination. It takes a lot of work to sell your house for retirement and find a place to settle down with so many options available. Working together with experts who can assist you with your real estate concerns will enable you to take care of business today while maximizing your retirement later.