Although it is evident that a housing bubble is unlikely to develop at any time, apprehensions of recession are still seeping everywhere. Eight out of ten recessions since World War II, have been caused by a decline in the property market. It is conspicuous from this startling statistic that this industry significantly influences the direction that an economy takes. Investors naturally worry about declining stock prices and the effects on their portfolios as the economy approaches a recession. Recent findings show some price reductions in certain areas (not all), rising unemployment claims, and slowing economic productivity. Therefore, some homeowners are starting to be conconered about the housing market’s future as recession rumors start to circulate in the mainstream.

Regardless of the uproar, a recession would seem unlikely given the low unemployment rate and the thriving economy. The global conflict has driven up the cost of essential commodities like oil, and the boom has resulted in soaring inflation. Some investors are dubious about how the Federal Reserve raises interest rates to combat rising prices without causing the nation’s economy to enter a recession. Moreover, if a recession does happen, investments—most importantly your real estate investments—may be affected. However, a recession alone does not necessarily foreshadow a housing meltdown.

Given what transpired during the Great Recession, how would a similar downturn impact real estate investors and the housing market as a whole if it occurred today? The following are some potential effects of a recession on the real estate market and investments.

Your real estate investments could generate consistent revenue

Since prices will be lower than they would be in a stable economy, a recession can be a beneficial moment for real estate investments. The worth of your real estate could then increase as the economy grows and consumers have more money to spend. Having real estate investments is a refuge against inflation. When you qualify for a fixed-rate loan to buy real estate, you secure your purchases, sometimes for up to 30 years. While the value of the dollar declines, the value of your property continues to increase while maintaining the same monthly mortgage payments.

Stock investments on the otherhand, have little chance when compared to the actual revenue of properties. Warren Buffet, possibly the greatest savvy investor and entrepreneur,, authored a special article on real estate investing for Fortune Magazine:

“Annual distributions now exceed 35% of our initial equity investment. Moreover, our original mortgage was refinanced in 1996 and again in 1999, moves that allowed several special distributions totaling more than 150% of what we had invested. I’ve yet to view the property”

-Waren Buffet, Forbes Magazine”

Another benefit is that REITs can generate dividend income, while direct ownership enables investors to keep rental income. In a downturn, real estate investments (rentals and Airbnb) offers predictability as a source of income. During a recession, tenants’ rent payments remain stable. When investors have control over rental prices, they can protect themselves against inflation and fluctuating interest rates. For instance, increasing the rent at lease renewals enables investors to keep up with inflation-related price increases. The consistency of the yield is what makes property investments better suited for enduring a recession.

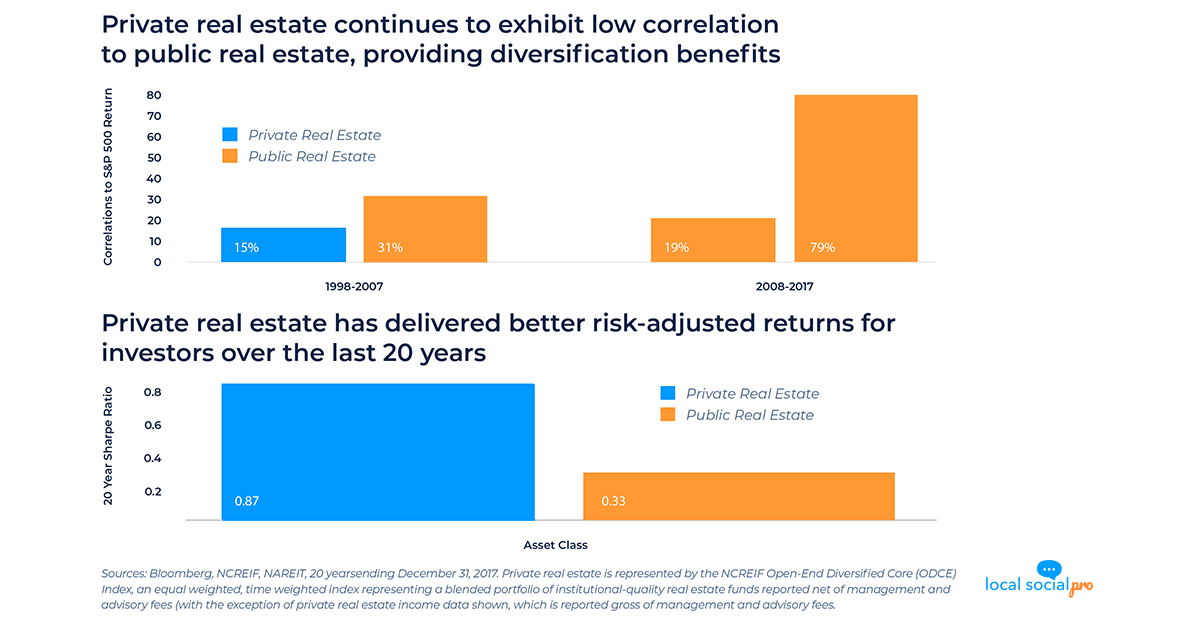

Your real estate investments could be less susceptible to volatility

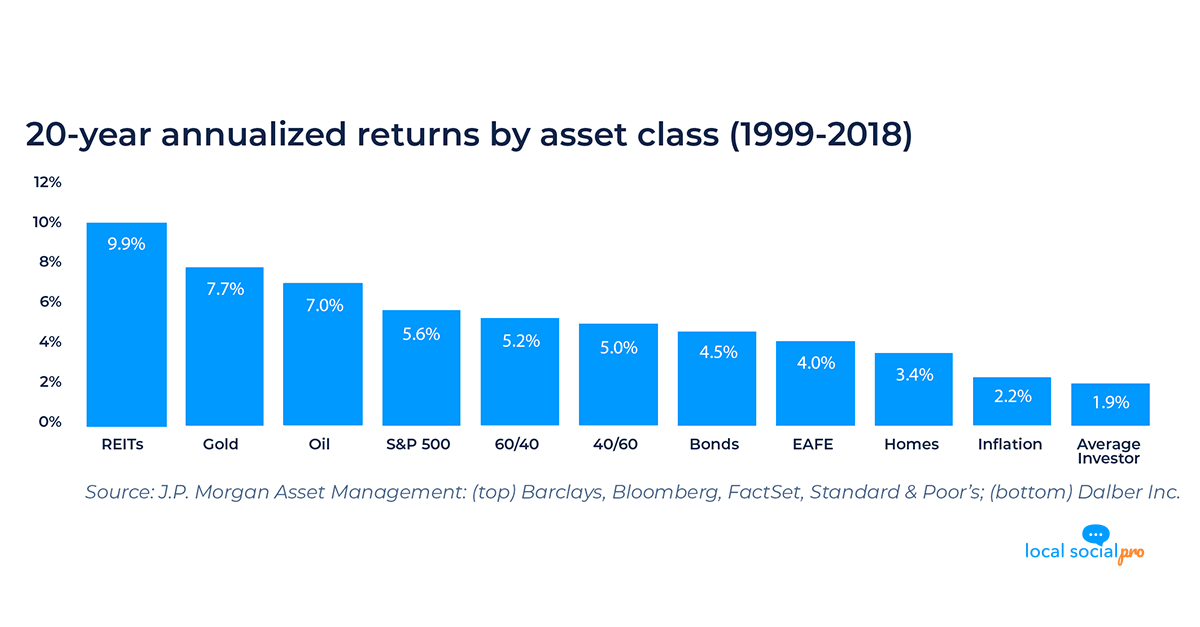

People still need to live, work, and maintain a lifestyle for their family even during an economic recession. Therefore, there will always be a market. Although stocks may be alluring given their convenience and liquidity, they come with a stipulation: the stock market is quite volatile. With a standard deviation adjusted for 20-year returns of only 6% compared to 13.8 % for the S&P 500, REITs significantly exceeded the S&P 500 over the 20 years from 2000 to 2020.

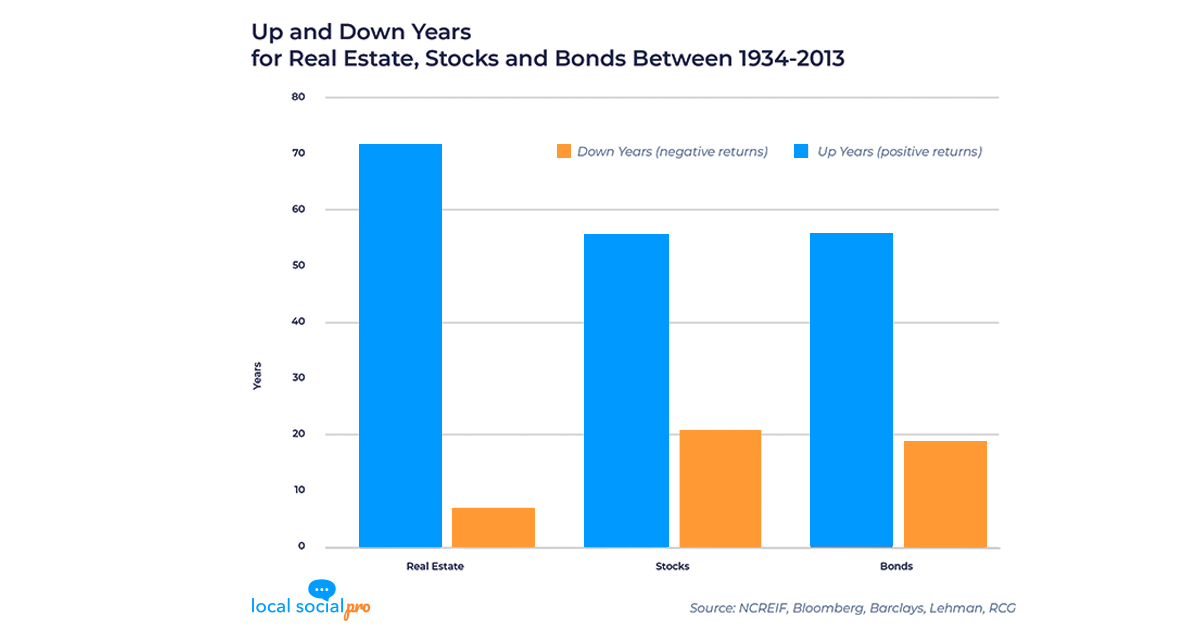

Real estate properties are typically still the rising investment at consistent rates, year over year, or at the very least keeping their prices level throughout recessions. While not fully resistant to volatility, real estate is undoubtedly the investment that resists changing the most when compared to other types. Consider the period of The Great Recession in 2008 as an illustration. However, during prior recessions, property values continuously increased. It was the only recession in which real estate values dramatically declined, particularly in the United States.

Your real estate investments are more beneficial than stocks and bonds.

If stocks and bonds struggle as the economy deviates into a recession, real estate can prove profitable. Direct investment of commercial multifamily real estate is a form of asset with low volatility, as compared to stock market investing. A recession can provide opportunities and it is a better hedge for inflation than bonds. Until the market turns back to low supply and great demand, investors can present those homes as rentals or rent-to-own opportunities. The property can then be put on the market at that stage. Over certain time periods, stock index funds may perform worse than inflation. These time periods may extend across several decades. For more than a decade, real estate has never outpaced inflation.

The Bottom Line:

Investors do three critical mistakes during a recession: some stay concerned, become fixated on current market conditions, and one day decide to liquidate their portfolio at the worst possible time. If you read the headlines during a recession, you could think that things are out of hand. However, being aware of the economic cycle might enable you in realizing that declines are a typical aspect of a healthy economy. In fact, buying a property during a recession can be a precautionary investment since it is a relatively stable asset. The upswing regarding real estate is that its value is not subject to irrational market swings brought on by human emotion and technology – It’s a tangible asset. Multifamily apartments are significantly safer and less volatile investments since families will always need a home. Creating a risk management plan based on your financial circumstances is crucial when the economy starts to exhibit signs of a recession.